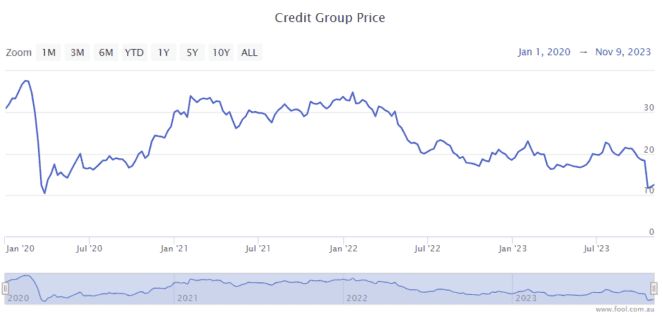

The Credit Corp Group Limited (ASX: CCP) share price has been crunched 40%, is this a good time to invest in the S&P/ASX 200 Index (ASX: XJO) share? A director certainly thinks so.

As we can see on the chart below, the business is close to a multi-year low and it's not far off the bad part of the COVID-19 crash. It was higher in April 2020 than it is today. It's down 40% from mid-September 2023.

For readers who don't know what the ASX 200 share does, it's a debt collector with operations in both Australia and the US, and it also has a lending division as well.

What's going wrong for Credit Corp shares?

The company recently held its annual general meeting (AGM) for shareholders and changed its guidance.

When it released its FY24 guidance in August 2023, it said it was expecting purchased debt ledger (PDL) investment of between $200 million to $250 million and net lending of between $45 million to $55 million.

The August guidance also suggested net profit after tax (NPAT) guidance of between $90 million to $100 million.

Credit Corp recently revised its guidance to include an impairment, which I'll talk about in a moment. PDL investment and net lending guidance were the same, but excluding the impairment, the underlying NPAT guidance for FY24 is $80 million to $90 million, while statutory NPAT is guided to be between $35 million to $45 million.

The company said that there has been a sustained deterioration in US collection conditions, with increased repayment plan delinquencies emerging in the FY23 fourth quarter and that has persisted throughout the first quarter of FY24.

That's why the ASX 200 share decided to re-forecast the remaining collections to reflect a continuation of these conditions over the medium term.

The estimated impairment is 14% of the FY24 opening US PDL book (being $45 million of NPAT). The current US segment NPAT outlook was reduced by $10 million.

However, Credit Corp did point to sustained US operational productivity improvement. Lending growth is "tracking to expectation" with "strong demand", arrears are dropping and the business is expecting free cash flow to jump in the second half of FY24 compared to the FY24 first half.

Director buys shares

It was recently announced by the ASX 200 share that director James Millar bought 9,000 Credit Corp shares for a total of $111,681. That works out to be a Credit Corp share price of $12.40.

When a director buys shares it's often seen as a vote of confidence in the company, as well as a tick of approval that the current valuation is attractive.

While the short-term may be uncertain and volatile, the business may be able to achieve a turnaround in the longer term. I'd say that's what management is thinking and hoping.