The Woodside Energy Group Ltd (ASX: WDS) share price is in the red today.

Shares in the S&P/ASX 200 Index (ASX: XJO) oil and gas stock are currently trading for $33.35 apiece, down 0.57%.

That's underperforming the ASX 200, which is up 0.25% at this same time. But with the oil price having dipped overnight, this is in line with the 0.47% loss posted by the S&P/ASX 200 Energy Index (ASX: XEJ).

Here's what else ASX 200 investors are considering.

What's happening with the ASX 200 energy stock?

On Monday, Woodside reported it had paid a whopping $3.7 billion in taxes and royalties to the federal and state governments in the first half of the year. That brings the company's Aussie tax and royalty payments to more than $18 billion since 2011.

"We take pride in the contribution we make to communities where we operate and we do the right thing when it comes to paying our taxes in Australia," CEO Meg O'Neill said.

The Woodside share price closed down 0.8% on Monday.

Today, the company held its investor briefing, where O'Neill highlighted its "high quality global portfolio with low cost and high margin operating assets".

With an eye on the future outlook for the Woodside share price, O'Neill said:

We have three world-class projects in execution in Australia, Senegal and Mexico. The combination of the strong base business and these new investments will generate strong future cash flows and returns for our shareholders across the price cycle.

The three projects she's talking about are Sangomar, located in Senegal; Scarborough, located here in Australia; and Trion, located in Mexico.

Sangomar is targeting first oil production in mid-2024. Woodside is aiming to commence production at Trion in 2028.

"The recent sell down of a 10% non-operating interest in Scarborough to LNG Japan demonstrated the value of the project to our customers," O'Neill said of the Australian-based project.

She noted that once Scarborough is up and operating, it will count "among the lowest carbon intensity sources of LNG when delivered into north Asia".

As for when investors can expect Scarborough to produce first gas, that could be in 2026. O'Neill said the project is "progressing well". The biggest question mark remains securing final regulatory approvals.

"We continue to engage with the offshore regulator and other stakeholders to progress secondary environmental approvals in support of our targeted first LNG cargo in 2026," she said.

As for the company's emission reduction plans, atop targeting hydrogen, ammonia and emerging fuels production, O'Neill said:

We are building a portfolio of offshore carbon capture and storage (CCS) opportunities with the view to decarbonising our base business and offering this as a service to customers. These opportunities have the potential to store more than three million tonnes per annum of carbon dioxide by 2030.

Woodside share price snapshot

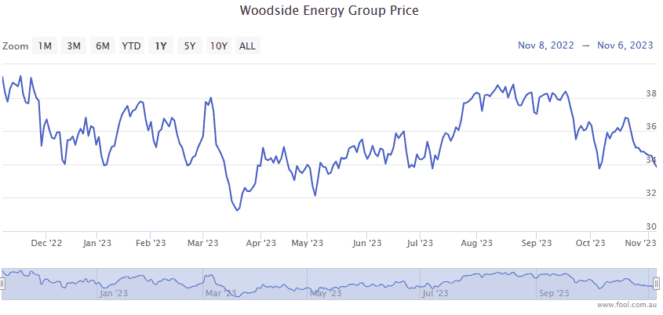

Pressured by a retrace in energy prices, the Woodside share price is down 6% in 2023.