The Piedmont Lithium Inc (ASX: PLL) share price is charging higher today.

Shares in ASX lithium stock were up 5.8% in earlier trade at 45.5 cents apiece. The share price has since come down to 44 cents, up 2.3% at the time of writing.

For some context, the All Ordinaries Index (ASX: XAO) is up 0.1%.

Here's what the ASX lithium miner just reported for the third quarter of 2023.

What happened with the ASX lithium stock during the quarter?

The Piedmont Lithium share price is getting a boost after the company reported on the inaugural revenue and profit achieved in the third quarter. This came following the start of lithium concentrate shipments in North America.

Piedmont reported revenue of US$47 million on sales of 29,011 dry metric tons (dmt) of lithium concentrate. That saw the company achieve a gross profit of US$24 million, for a gross profit margin of 50.4%.

Net income came in at US$23 million with adjusted net income of US$17 million.

And adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) reached US$16 million.

Despite these solid maiden metrics, the Piedmont Lithium share price closed down 1.5% in US markets overnight, where the stock is listed on the NASDAQ. That may have been due to the results missing some optimistic analyst estimates.

Commenting on the quarterly results, Piedmont Lithium CEO Keith Phillips said:

The third quarter was transformational for Piedmont as we made our first customer shipments under our offtake agreement with our joint-venture operation, North American Lithium [NAL]. As a result, Piedmont became a revenue-generating lithium company…

Phillips noted that NAL is the largest operating lithium mine in North America, with production "ramping up well".

The company's revenue and profits could have been significantly higher, with Phillips pointing to a material impact driven by a 45% decline in spot lithium prices during the quarter.

According to Phillips:

Virtually all of our offtake tonnage will eventually be sold under long-term contracts announced earlier this year, but initial shipments are being made on the spot market. The benchmark spodumene concentrate price fell from more than US$3,500/dmt at the start of the quarter to approximately US$1,900/dmt today.

Piedmont Lithium reaffirmed that it remains on track to deliver its full-year shipment guidance of some 56,500 dmt of lithium concentrate.

The company held cash and cash equivalents of US$95 million as at September 30.

Piedmont Lithium share price snapshot

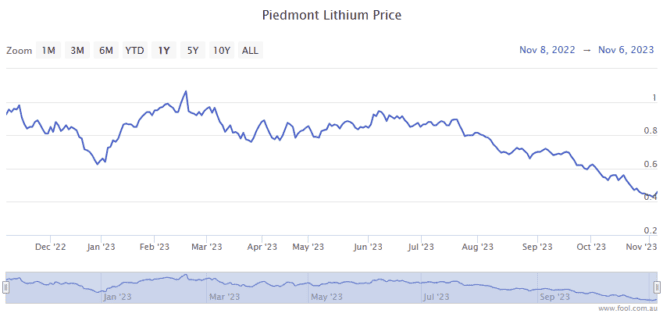

Despite today's lift, the Piedmont Lithium share price remains down 33% in 2023.