Commonwealth Bank of Australia (ASX: CBA) shares are joining in the broader Fed-fuelled market rally today.

In early afternoon trade, shares in the S&P/ASX 200 Index (ASX: XJO) bank stock are up 1.6% at $98.44 apiece, outpacing the 1.3% gains posted by the ASX 200 at this same time.

That means investors hoping to see CBA shares deliver a dividend yield of 5% will need to wait, either for those dividends to rise or for the bank's share price to slide.

What kind of dividend yield are CBA shares paying?

Although still yielding less than 5%, stock in Australia's largest bank remains a go-to for many passive income investors.

That's partly due to CBA paying fully franked dividends, providing many investors with tax benefits when it's time to pay the ATO its take. CommBank also has a long record of paying two dividends annually, including in 2020 when markets were roiled by the COVID pandemic.

Most recently, the final dividend of $2.40 per share landed in eligible investors' bank accounts on 28 September. That was up 14% from the prior year's final dividend, thanks to a 13% year on year boost in the company's operating income, which reached $27.24 billion in FY 2023. The bank's cash net profit after tax was up 6% from FY 2022 to $10.16 billion.

Adding in the $2.10 per share interim payout, and CBA shares have delivered a total of $4.50 per share in fully franked dividends over the past 12 months.

At the current share price that equates to a trailing yield of 4.6%. Not bad.

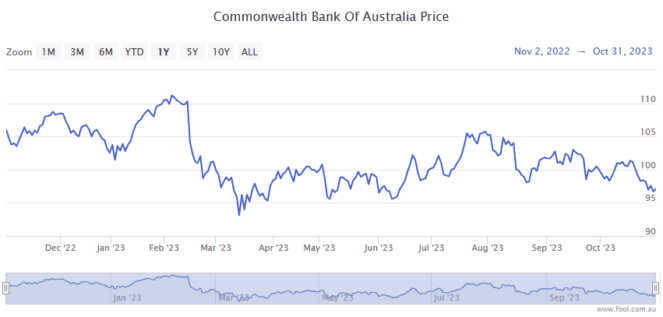

But should the yield reach 5%, it would imply the CBA share price has dropped to $90.

That's about 8.5% below the current price. And it would lock in higher potential yields for investors buying at that price.

For example, in September, UBS forecast that CommBank will deliver $4.76 per share in dividends for the full 2024 financial year. Buying in at $90 a share will see investors earning a yield of 5.3% if UBS has this one right.

So, should you buy CBA shares when the dividend yield hits 5%?

While every investor needs to decide what's best for their own needs, buying Australia's biggest big bank for $90 a share would look like a solid entry point to me.