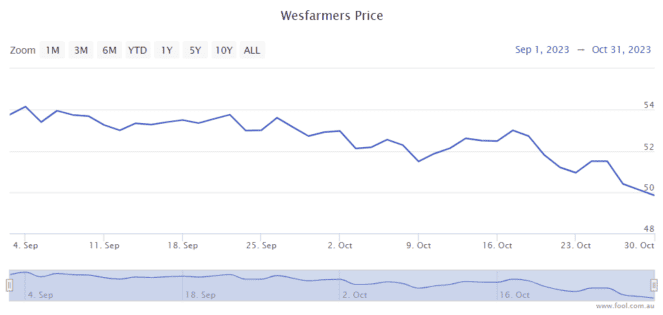

The Wesfarmers Ltd (ASX: WES) share price has been drifting lower over the past two months, as we can see on the chart below. As the business is now lower than the September price, it's worth asking whether this is an opportunity to buy the dip with this blue chip in November.

For readers that may not know what this business does, it's the owner of brands like Bunnings, Kmart, Officeworks, Target, Catch and Priceline.

It also has industrial businesses, including ones focused on safety, as well as the chemicals, energy and fertiliser (WesCEF) division.

Is the outlook promising for Wesfarmers shares?

We shouldn't base an investment decision on one month, but the retail numbers from the Australian Bureau of Statistics (ABS) for September 2023 were promising. The ABS said that seasonally adjusted sales rose 0.9% month over month.

The ABS numbers showed that household goods retailing increased 1.5%, department stores turnover rose 1.7%, clothing, footwear and personal accessories saw a 0.3% rise and 'other retailing' saw a rise of 1.3%.

That was a large month-over-month increase and may imply that sales continue to perform well for some of Wesfarmers' businesses, which in turn may support the Wesfarmers share price.

I don't know whether this sort of growth will continue, but the company's financials should benefit if national retail sales are increasing. Revenue growth can help maintain, and even improve, profit margins.

However, revenue is only one side of the equation. There's also the question of costs – inflation of wages, the supply chain and so on makes it difficult to improve profit margins in the short term.

But, Australia's population continues to grow strongly, so I suspect this will help offset any household expenditure at Wesfarmers' stores.

The business recently invested $26 million to increase its presence in the lithium space by acquiring 65% of all mineral rights other than gold and by-products held by Ora Banda Mining Ltd (ASX: OBM) with the Davyhurst tenement package.

Perhaps more importantly, Wesfarmers is getting closer to finishing the Mt Holland lithium project, which could significantly boost earnings, depending on what happens with the lithium price.

Time to buy?

The Wesfarmers share price has fallen under $50 multiple times over the past year, so this is certainly not the cheapest it has been in 2023. However, there's no rule that says it's going to fall back to that 52-week low valuation.

I'd like to take the opportunity to buy Wesfarmers shares for my own portfolio, it has such an impressive history of long-term wealth creation by growing high-quality businesses like Bunnings and Kmart.

I'd prefer to buy it at an even cheaper price, but the current price/earnings (P/E) ratio seems compelling with Australia's growing number of shoppers and the rising turnover for retailers.

Using the projections on Commsec, it could generate $2.19 of earnings per share (EPS) in FY24 and $2.53 of EPS in FY25. This would mean forward P/E ratios of 23 and 20, respectively.