BHP Group Ltd (ASX: BHP) shares are shaking off the broader market malaise on Monday and marching higher.

Shares in the S&P/ASX 200 Index (ASX: XJO) mining giant closed Friday trading for $45.06. As we head into the lunch hour, shares are swapping hands for $45.29 apiece, up 0.5%.

That compares to a loss of 0.7% posted by the ASX 200 at this same time. The S&P/ASX 300 Metals & Mining Index (ASX: XMM) is also up 0.5%, with the big miners enjoying a 2.3% boost in the iron ore price to US$119.75 per tonne.

That's the latest price action for you.

Now what's this about BHP shares pivoting to renewables?

What are the ASX 200 miner's coal plans?

Last year BHP noted its intent to obtain mining permits to continue operations at its New South Wales Mt Arthur coal mine, located in the Hunter Valley, until 2030. Though those plans came under renewed scrutiny following the temporary introduction of a coal price cap at $125 per tonne, which is set to expire on 1 July 2024.

Now, as The Australian Financial Review reports, BHP shares could be linked to a major renewable energy project. The ASX 200 miner indicated in its closure planning documents with the NSW government that Mt Arthur could be used to produce hydropower after coal mining at the site comes to an end in 2030.

One post-operations plan would see Mt Arthur transformed into grazing land and forests.

However, paddocks and woodlands might not offer the economic benefits the miner says many local residents expressed support for in community surveys.

According to BHP:

A significant portion of feedback received from consultation undertaken for the modification focused on a preference for beneficial alternate mine land re-uses for the site, namely uses that generate continued significant economic activity.

Ideally, ongoing uses that generate continued economic activity and diversification outcomes.

BHP is still studying various options for its Mt Arthur site once coal mining ends there. And the ASX 200 miner isn't yet seeking approval for any specific plan.

But a major renewable energy project remains on the table.

"Mt Arthur Coal post closure could lend itself to potential renewable energy projects including pumped hydro energy storage stations and solar generation," BHP said in its statement.

How have BHP shares been tracking?

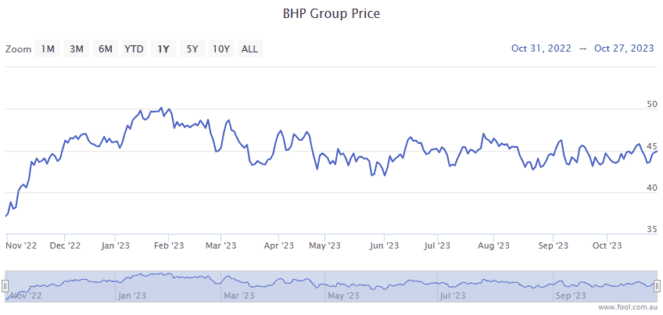

BHP shares are up 21% since this time last year when the iron ore price was trading below US$100 per tonne.