The Pilbara Minerals Ltd (ASX: PLS) share price has jumped 4% today after yesterday's rough session. It's still down 3% for the week, though some of the ASX lithium share's decline has been recovered. There may be a reason for today's rise, which I'll cover in a moment.

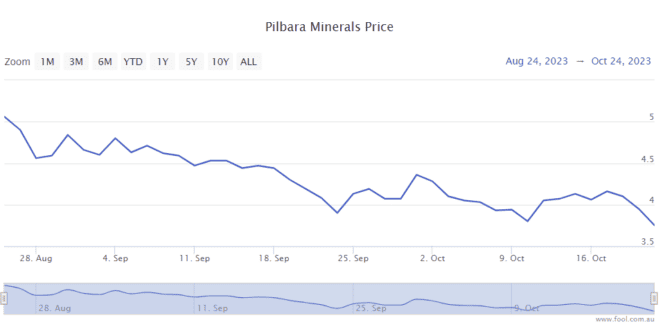

As we can see on the chart below, it's been a rough period for the company. It's down more than 25% in just two months.

Pilbara Minerals shares upgraded

According to reporting by The Australian, the broker Jarden Securities has increased its rating on the ASX lithium share to a buy.

It's not the only expert view that rates it as a buy, there are at least nine analysts that rate it as a buy according to Factset.

Some investors like to buy the dip when it comes to ASX mining shares because of how cyclical and volatile they can be.

Why be positive about the ASX lithium share?

It's an interesting period, in the short-term, for the lithium sector because the lithium price has significantly fallen in recent times. The Pilbara Minerals share price tends to track the lithium price in the short term.

The latest quarterly report from the Department of Industry, Science and Resources included some commentary about lithium. The report for the three months to September 2023 was released in early October.

It said that prices are expected to fall as the lithium market enters a "sustained period of surplus supply." This will be partly offset by rising export volumes and a growing share of lithium refined to a higher-value product domestically.

However, the report did say that the lithium price is expected to remain "well above pre-2021 levels".

Australia's lithium mine production is growing because of expansions and new mines. This country now accounts for half of global lithium extraction and rising production is meeting the growing global demand for lithium batteries.

Pilbara Minerals itself is expecting to increase its lithium production by 70% over the next two years, with a goal of 1mt per annum, subject to the completion and commissioning of the P1000 project.

While there may not be strong conditions for lithium in the short-term, Pilbara Minerals points to there being an expected deficit in lithium by 2040 to an equivalent of between 12 to 20 Pilgangooras, depending on potential supply coming online. If it did reach that imbalance, that could be very helpful for the Pilbara Minerals share price over time.