Westpac Banking Corp (ASX: WBC) shares are in the green today, up 0.5%.

In afternoon trade on Tuesday, shares in the S&P/ASX 200 Index (ASX: XJO) bank stock are changing hands for $20.92 apiece. Westpac shares closed yesterday at $20.94.

For some context, the ASX 200 is just about flat at this same time.

That's the latest market action for you.

Now here's what's happening in the big bank's boardroom.

Another board shakeup

There have been a few noteworthy changes on the Westpac board this month.

If you own Westpac shares, you may have followed last week's announcement of Steven Gregg's appointment as a non-executive director and chairman-elect. Gregg will replace outgoing chairman John McFarlane.

Today, the bank announced the pending departure of Chris Lynch, an independent non-executive director. Lynch has opted not to stand for re-election and will step down from the board on 14 December.

Lynch has served on the audit, remuneration and risk committees since joining the Westpac board in September 2020.

"I'm sorry to see Chris step down from the board," McFarlane said.

"He made a significant positive impact as CFO and director at BHP and Rio Tinto, and also as CEO of Transurban," McFarlane added. "Over the past three years he brought that expertise and financial acumen to Westpac and the company is all the better for it."

"A strong banking sector is essential for the Australian economy," Lynch said. "And I've valued the opportunity to make a contribution during Westpac's recent period of transformation."

How have Westpac shares been tracking?

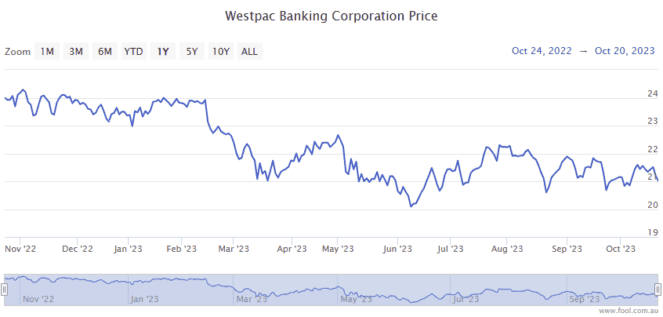

Westpac shares have underperformed the benchmark year to date, losing 8% in 2023.