With the S&P/ASX 200 Index (ASX: XJO) now down around 7.5% since the start of August, it's probably fair to say that investing in ASX growth shares isn't exactly in vogue right now.

But unlike many investors, low share prices don't put me off buying up my favourite growth stocks. As we discussed just this week, low prices give us the opportunity to buy more of our favourite shares for the same amount of money.

With that in mind, I'm currently eyeing off my favourite ASX growth share on the stock market.

Well, it's not exactly a share, but rather an exchange-traded fund (ETF).

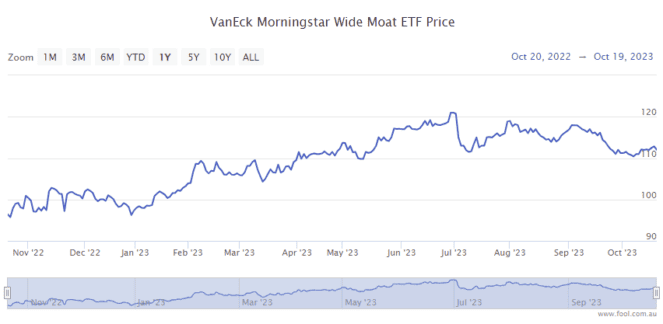

The VanEck Morningstar Wide Moat ETF (ASX: MOAT) is a long-term holding of mine, and has been one of my favourite investments for years now. And at present, units of this growth-orientated ETF are more than 8% down from the all-time high that we saw at the end of June.

That's got me very interested indeed.

The VanEck Morningstar Wide Moat ETF is a rather unique fund on the ASX. It's not really an index fund, with a team of investors at Morningstar individually picking the different investments that constitute its portfolio.

Normally, I shun active ETFs of this nature. I usually prefer the low-cost index funds that track broader markets like the ASX 200. But in this ETF's case, I make an exception.

What's to like about a MOAT?

Why? Well, I believe the methodology that is used to construct this ETF is a highly successful one.

When selecting companies for MOAT's portfolio, only companies that demonstrate that they possess characteristics of an economic moat are chosen for this ETF's portfolio. An economic moat is a term coined by legendary investor Warren Buffett. It refers to an intrinsic competitive advantage that a company possesses.

This could be a strong, powerful brand or a product that is difficult to switch away from. It could also be a low-cost advantage that enables a company to sell goods or services at lower prices than competitors.

Only companies that have one or more of these sorts of characteristics make it into MOAT's portfolio.

Looking at the ETF's current makeup, we can see this playing out in real time. At present, this ETF holds shares in the likes of Google-owner Alphabet, Disney, Nike, Microsoft, and Domino's Pizza. Even Buffett's own Berkshire Hathaway makes the cut.

But the MOAT ETF's true appeal to be lies where its rubber hits the proverbial road — performance.

This ETF is my favourite ASX growth stock

This ETF's methodology has enabled it to deliver some truly incredible returns for investors over long periods of time.

As of 30 September, the VanEck Wide Moat ETF has delivered an average return of 27.22% over the preceding 12 months. That lowers to 16.74% per annum over the past three years and 14.09% over the past five.

So it's for all of these reasons that I love investing in the VanEck Mide Moat ETF, and I'm eyeing it off today while it is so far from its June all-time highs.