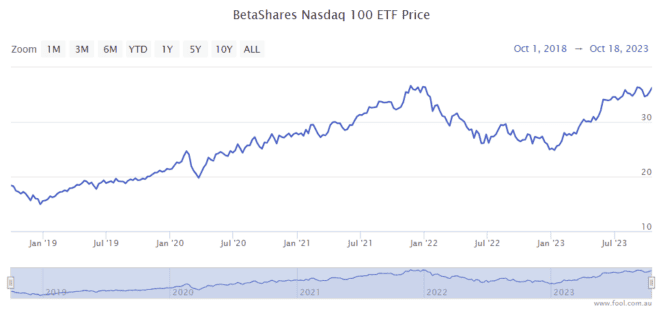

The Betashares Nasdaq 100 ETF (ASX: NDQ) has done incredibly well in the shorter-term and longer-term. Just look at the chart below, in the past year the unit price has gone up 30% and over the past five years it has climbed 105%.

It has been a strong period for the US share market, driven by the US tech giants. After such a strong run, investors may be wondering whether now is a good time to invest.

Don't interest rates matter?

The NDQ ETF unit price is now close to surpassing its November 2021 peak. While earnings for plenty of companies have continued to rise, the US (and Australia) interest rate is now much higher.

Why do interest rates matter? Warren Buffett, the famous investor from Omaha once explained:

The value of every business, the value of a farm, the value of an apartment house, the value of any economic asset, is 100% sensitive to interest rates because all you are doing in investing is transferring some money to somebody now in exchange for what you expect the stream of money to be, to come in over a period of time, and the higher interest rates are the less that present value is going to be. So every business by its nature…its intrinsic valuation is 100% sensitive to interest rates.

Plenty of investors have questioned whether valuations make sense at the current level.

It's definitely possible that share prices could fall. But, no one has a crystal ball. The share market's performance between 2010 and 2019 seemed unbelievable, yet it kept rising for a long period of time.

This clearly isn't the best time to invest as the NDQ ETF is now much higher than it was last year, meaning it isn't as cheap. However, it wouldn't surprise me if the Betashares Nasdaq 100 ETF fell 10% or more between now and the end of 2023.

In saying all that, there are a couple of key reasons why I think it could still make good returns from here.

Positive case for NDQ ETF

Past performance is not necessarily a guarantee of future performance. However, the underlying business growth by names like Apple, Microsoft, Amazon.com, Alphabet and Meta Platforms has been impressive.

I don't think the longer-term direction of profit generation of these businesses is suddenly going to change – I think these companies can continue introducing new and improved products and services that get households and businesses to spend their money, enabling their bottom lines to keep improving over time. For example, cloud computing, AI, digital advertising and online video seem like areas that (globally) still have a long growth runway.

The NDQ ETF is invested in 100 businesses, so it has solid diversification and the names in the portfolio regularly change as new stars rise, ensuring that Aussie investors are able to access many of the most exciting large businesses.

There could be a sizeable decline in the next 12 months, but I believe in the long-term potential of this group of businesses. Even if the NDQ ETF were to fall 20% in the short term, I think it can deliver much stronger returns over the next three to five years.