As the old cliche goes, everything has a price.

So while the business prospects may not have changed, ASX stocks that may not have interested you in the past could become much more compelling because of a significant price drop.

And that's the situation with the following three cheap shares, all of which Shaw and Partners portfolio manager James Gerrish would now buy "into weakness":

2023 is 'a likely trough' for these cheap shares

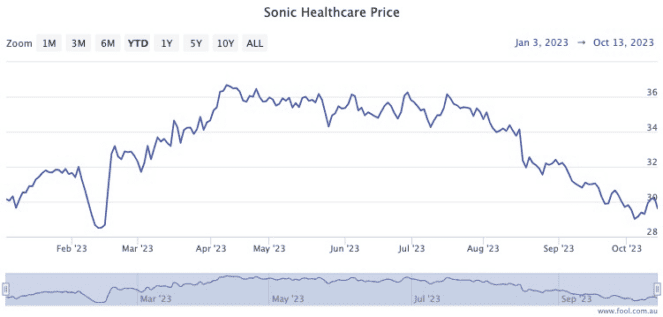

It's been a wild ride for Sonic Healthcare Ltd (ASX: SHL) investors this year.

While the stock price is almost flat year to date, it has nosedived 16.9% since 17 July.

Gerrish, in a Market Matters Q&A, said that the whole healthcare sector has been suffering a decline the past few months, plus costs were a concern in Sonic's annual results.

"They delivered a 6% profit miss at FY23 earnings, driven by rising labour costs."

Despite those challenges, his team believes "the shares are currently trading at reasonable value".

"Moving forward a better revenue collection system in the US reduces claims denials and will be launched in 2H24, extra revenue from this drops directly to the bottom line."

The worst could now be behind the healthcare provider.

"With further COVID cost-out this reshapes the earnings trajectory suggesting that FY23 is a likely trough, and we see high single digit growth from here," said Gerrish.

"Hence we like Sonic Healthcare into weakness."

No more downside for perennial underachiever?

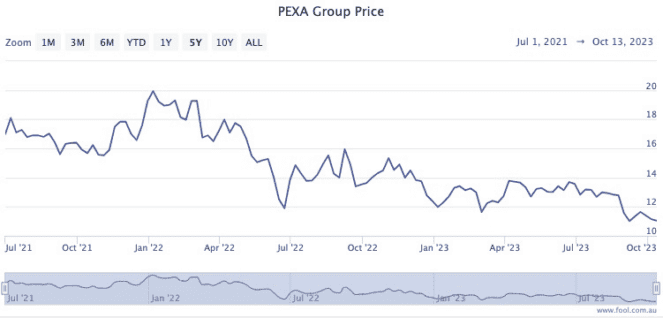

PEXA Group Ltd (ASX: PXA) has been disappointing for investors since it listed on the ASX in mid-2021, dropping 36.5% since the first day's closing price.

It's been the same old story in recent weeks for the digital real estate settlements platform.

"The company's FY23 result… was mixed, but ultimately a FY loss of $21.8 million, which is not good but largely expected as they invest for future growth.

"However, the stock fell away after their guidance for FY24 implied more of the same."

However, similar to Sonic, Gerrish's team thinks there's upside for Pexa from this point on.

"We're of the view that conditions should be improving," he said.

"This particular investment thesis may take longer to play out. However, their UK business will be a very good one and their platform in Australia is excellent."

Gerrish's analysts like Pexa's current share price and they actually own it in their emerging companies portfolio.

'Most potential upside' for 'world class assets'

Global Lithium Resources Ltd (ASX: GL1) shareholders are suffering more than most, with the stock plunging 40.6% since January.

But with all the corporate activity in the lithium sector, according to Gerrish, Global Lithium has plenty of potential.

"This $360 million junior lithium has world class assets, which could see plenty of interest at some point down the track from larger players."

Global lithium prices have floundered the past couple of months due to the spluttering Chinese economy.

"Most lithium stocks have followed suit. The smaller operators not yet in production like Global Lithium have struggled most," said Gerrish.

"However, they also have [the] most potential upside for those happy to take on some risk ahead of first production likely in 2025."

Gerrish's team also holds Global Lithium in its emerging companies portfolio.