Westpac Banking Corp (ASX: WBC) shares are up 0.8% today.

The S&P/ASX 200 Index (ASX: XJO) bank stock closed yesterday trading for $21.31 per share. In early morning trade on Tuesday, shares are changing hands for $21.47 apiece.

For some context, the ASX 200 is up 0.6% at this same time.

That's the latest price action for you.

Now, here's the latest leadership change announced yesterday by the big bank.

New chair named at ASX 200 bank

If you own Westpac shares, or are pondering buying them, then Steven Gregg is a name to know.

On Monday, Westpac announced the appointment of Gregg as a non-executive director and chairman-elect. Gregg will take up the role on 7 November, subject to regulatory approvals.

Gregg is replacing outgoing chairman John McFarlane.

"Steven is the right leader to take Westpac into its next chapter," McFarlane said.

McFarlane added:

With a long career in corporate and investment banking across Asia, Europe and the US, combined with his experience chairing ASX100 companies, Steven is a world-class executive and director who will bring a fresh perspective to the board.

He has deep experience chairing consumer-focused companies, a strong track record of disciplined decision making and contributions to board oversight of organisations undergoing technology transformation.

Gregg said he was honoured to be appointed chair of Westpac.

"Westpac is a wonderful company, the oldest company in the country, the first bank, and an organisation that has so much potential. I look forward to making a big contribution," he said.

According to Gregg:

From my observation, Westpac is in a period of transition. After the hard work of simplification over the past three years, now is the time to look forward and have a strong ambition. My priority will be working closely with fellow directors and the management team to deliver the very best service for our customers and better returns for our shareholders.

Gregg said it was a privilege for him to be able to build on the important work being done at Westpac over the past few years.

How have Westpac shares been tracking longer-term?

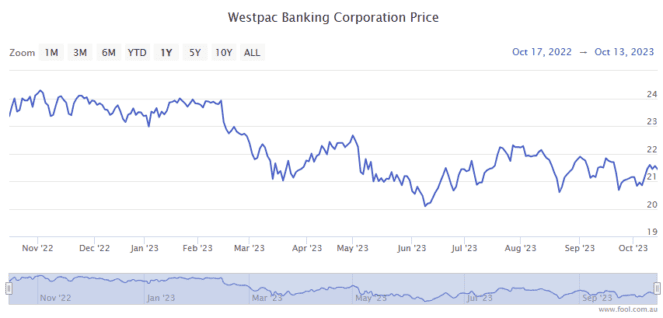

Westpac shares are down 8% over the past 12 months.