The Betashares Global Cybersecurity ETF (ASX: HACK) is an exchange-traded fund (ETF) that I'm excited about for the long term. There's a good chance HACK ETF units could end up in my portfolio in the next few weeks or months.

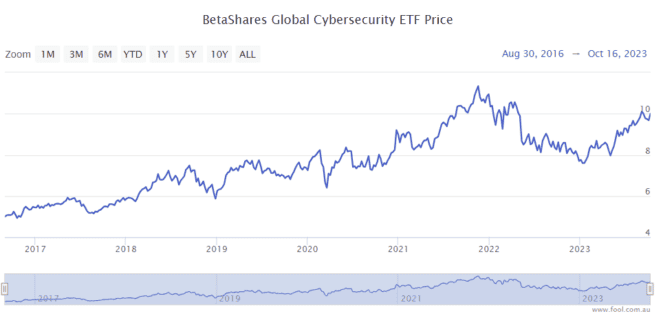

Past performance is certainly not a guarantee of future performance, but the HACK ETF has done very well since it started on 30 August 2016, as we can see on the chart below.

According to BetaShares, since its inception, the Betashares Global Cybersecurity ETF delivered an average return per annum of around 16% to 29 September 2023.

I don't think something is a buy just because it has gone up, nor do I think we should sell something just because it has gone down. Interestingly, the HACK ETF unit price is still down 11% from its peak in November 2021, so it seems cheaper to me.

But, there are a couple of key reasons why I think the HACK ETF is a long-term buy.

Long-term revenue growth

According to BetaShares sources (Statista), the global cybersecurity market is expected to grow from US$223.68 billion in 2022 to US$345.4 billion in 2026. By 2030 it could reach US$478.7 billion, which means it could more than double in eight years.

There is sadly a growing trend of cybercrime across the world, in terms of both the number of cybercrime events and the cost of those attacks. More business is done online and more things are connected to the internet, including the access of sensitive digital information.

Cybersecurity Ventures expects global cybercrime costs to grow by 15% per annum between 2020 to 2025 to US$10.5 trillion, up from US$3 trillion in 2015. There's clearly a major motive here for individuals, businesses and governments to get and/or improve their cybersecurity. And the cybersecurity businesses can deliver a lot of value if they protect their clients.

I think there's going to be growing demand for cybersecurity in the long term as more of the world transitions to cloud services, which should help the HACK ETF. Just think how important it is that everything on Australia's MyGov system remains safe and protected from cybercriminals.

The nature of providing digital services, as cybersecurity businesses do, makes me believe that these businesses can grow their profit margins as they become larger thanks to operating leverage. To me, that suggests that the predicted revenue growth can enable very pleasing profit growth, which is often how investors value a business.

Defensive earnings

In my eyes, cybersecurity services demand seems like it could be very consistent. Some people may decide to not buy a TV or a couch during an economic recession, and a business may decide to reduce its advertising, but I believe a business would want to maintain its cyber defences even if revenue falls.

Governments will still need to protect their citizens' information even if the tax receipts decline in one year.

This suggests to me, in my opinion, that the HACK ETF could see both growing earnings and defensive earnings, which means it could outperform during good times and tougher times over the long term.

So, with whatever happens next, the Betashares Global Cybersecurity ETF could be an attractive investment to own.