The S&P/ASX 200 Index (ASX: XJO), unfortunately, has had a bit of a shocker the past few weeks.

The index is now down almost 5% since the start of September, as the world grapples with high bond yields and persistent inflation.

However, that means that quite a few individual ASX 200 stocks for quality companies are now going for a heavy discount.

Here are two such examples named as buys by experts this week:

Company providing 'customers significant cost savings and convenience'

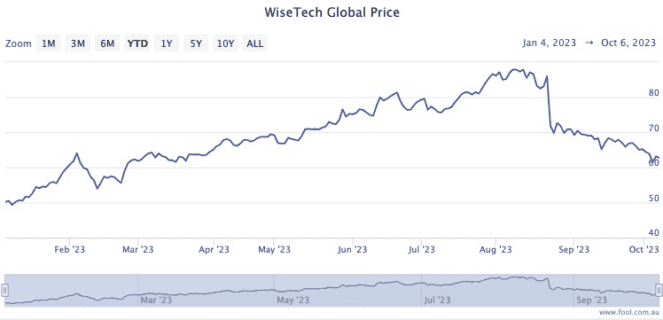

WiseTech Global Ltd (ASX: WTC) shares have shockingly tumbled 27.8% since 22 August.

Bell Potter private wealth advisor Christopher Watt reckons it's time to pounce.

"The recent sell-off presents a buying opportunity after the company provided lower than expected underlying earnings guidance for fiscal year 2024," Watt told The Bull.

The fact remains that the company is a dominant player in its field.

"WiseTech provides software solutions to the global logistics industry. It services more than 12,000 customers, including 43 of the top 50 global third party logistics providers."

In times of economic uncertainty, WiseTech's products provide a boost for clients.

"Logistics is typically managed by in-house businesses, so WiseTech's platform offers customers significant cost savings and convenience."

CMC Markets at the moment shows eight out of 15 analysts recommending WiseTech as buy, with no one rating it as a sell.

Growing 'regardless of macroeconomic headwinds'

A business that's decidedly old school compared to WiseTech is Transurban Group (ASX: TCL), which operates many toll roads around Australia.

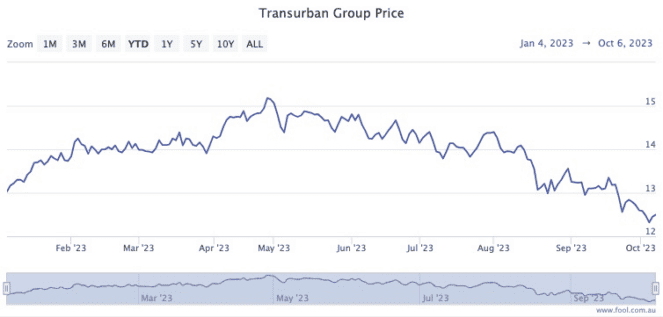

The share price has steadily dropped 17.6% since April, but for Catapult Wealth portfolio manager Tim Haselum it's a buy.

He loves the resilience of its business model.

"We expect earnings for this toll road operator to grow at a moderate pace regardless of macroeconomic headwinds."

Plus all the headwinds that would boost Transurban are undeniable.

"A combination of growing traffic volumes, higher tolls and new projects are drivers of the share price," said Haselum.

"Most tolls are linked to inflation. Most debt is fixed. Declining bond yields should also support the share price in the medium term."

A dividend yield of 4.6% also soothes the share price volatility too.

Seven out of 16 analysts currently surveyed on CMC Markets rate Transurban as a buy.