ASX mining shares continue to pique the interest of investors who are finding the prospect of buying stocks at the bottom of a cyclical industry compelling.

The global economy is now dealing with multiple headaches: a war each in Europe and the Middle East, stubborn inflation, high oil prices, the impact of steep interest rate rises, and deflation in China.

That all means demand for minerals is at a low point of the cycle. The theory is that, in the medium term, conditions for resources stocks could only improve.

So if you're a disciple of the "buy cheap mining stocks now" philosophy, you might be interested in these three stocks that the team at Celeste Funds named recently:

The good stuff

Iron ore is a basic building block for infrastructure and, as such, the demand for it is very much a bellwether for the global economy.

Celeste analysts are thus bullish on both Deterra Royalties Ltd (ASX: DRR) and Champion Iron Ltd (ASX: CIA).

Both are a bit different from the typical iron ore miner.

For Champion Iron, the quality of its products sets it apart.

"CIA offers exposure to high-grade iron ore out of their Bloom Lake project that should be a substantial beneficiary of a decarbonisation of the steel industry," the Celeste team stated in a memo to clients.

Higher grade means less contaminants in the iron ore, so the processing into steel is less polluting.

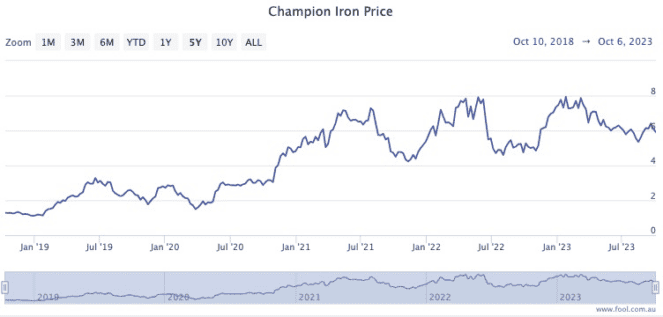

Like most mining stocks the Champion Iron share price has been volatile, but it has managed to gain an impressive 369% over the past five years.

Not getting your hand dirty

Deterra Royalties, meanwhile, doesn't itself dig any stuff out of the ground.

It simply is the "landlord" for one of BHP Group Ltd (ASX: BHP)'s mines, and the royalties it receives is its sole source of revenue.

"DRR continues to provide long-term exposure to long-term royalty cash flow out of BHP's flagship Mining Area C, while also receiving one-off payments as production reaches nameplate capacity."

The Celeste analysts noted that there are "growing expectations" that the central bank in China will be forthcoming with stimulus to kick-start the nation's stalling economy.

Location location location

The third mining tip from Celeste is Bellevue Gold Ltd (ASX: BGL), which has risen 25.8% year to date but has dropped nearly 13% since the end of August.

The recent plunge was more to do with the global gold price, according to the analysts, rather than the business.

"During the month, Bellevue Gold provided a strong drilling update, also confirming they remain on track for first production in the upcoming December quarter.

"The update also noted the second campaign of toll treating is underway, which should alleviate any funding concerns."

Bellevue calls its Western Australian mining site "exceptionally high-grade" and "world class".

It seems the Celeste team agrees.

"We remain positively disposed to the attractive economics of the project and its tier-1 location."

According to CMC Markets, many of Celeste's peers agree, with four out of five analysts rating Bellevue shares as a buy.