Thanks to the magic of compounding and ASX shares, it doesn't take a massive amount to get started on a journey to significant passive income.

How would you like your regular wages supplemented with $18,000 that you didn't have to work for? Sounds pretty good, right?

Let's see how the ordinary punter can get themselves to that position in just 10 years:

Let's create a diversified stock portfolio

Comparison site Finder recently conducted a survey that found the average Australian had $39,459 saved up.

So let's start with that to build a stock portfolio.

To grow it to a nest egg capable of producing $18,000 of passive income, I would choose a diversified basket of growth shares.

Note the word diversified.

Experts say diversification is the only free lunch in investing because you don't want your success to all hinge on the fortunes or misfortunes of one particular sector or region.

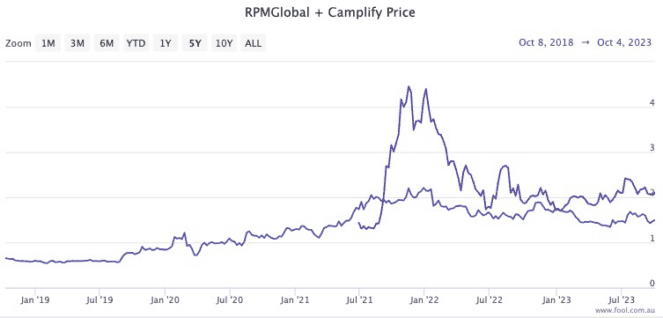

Three examples of growth stocks ripe for long-term investing are Xero Limited (ASX: XRO), Camplify Holdings Ltd (ASX: CHL), and RPMGlobal Holdings Ltd (ASX: RUL).

I consider them quality businesses that are making great strides in expanding their revenue and profitability.

And they play in different sectors and geographies to provide decent diversification.

New Zealand company Xero makes accounting software for small and medium-sized business clients. Its biggest market is Australia and New Zealand but is growing its presence in North America and the United Kingdom.

Camplify's customers are consumers who are seeking short-term rentals of campervans from private owners. It's a platform like Airbnb Inc (NASDAQ: ABNB) but for recreational vehicles.

Big mining companies are the ones who buy RPMGlobal's technology and consulting services.

Add to it regularly and watch the investment grow

Remembering that past performance is no indicator of what the future holds, let's take a look at how these shares went in recent years so we can hypothesise about how our portfolio could grow.

The Xero share price has gained more than 160% over the past five years, despite plunges during the first COVID-19 wave and the 2022 growth stock sell-off.

Camplify listed in late June 2021 and over the past three-and-a-bit years has rocketed 65%.

Meanwhile, RPMGlobal shares have soared in excess of 137% over the last half-decade.

All three have capital growth rates that exceed doubling of the share price in five years.

But let's be conservative with our calculations and assume our diversified portfolio can double each half-decade.

That equates to a compound annual growth rate (CAGR) of 14.87%.

This means that your $39.459 portfolio, with $100 added each month, could grow to a tidy $182,048.54 after 10 years.

Now we can get our grubby hands on some passive income.

Collect your passive income cheque every year

From this point, there are a couple of ways of harvesting passive income.

The straightforward method is to leave the portfolio as is and simply sell any gains made each year.

Even if the companies mature and the CAGR can't quite stay at 14.87%, a 10% return each year will allow you to pocket $18,205 of passive income.

Nice work!

The pro of this route is the simplicity in transition from growth to the income phase. The con is that the income could be quite volatile.

As we all know, share markets can have wildly fluctuating fortunes from year to year. That means that while the average payout could be $18,000, some years you might see nothing while other times you may receive an absolute windfall.

If you sought more stability in income, you may consider switching the portfolio over to ASX dividend shares.

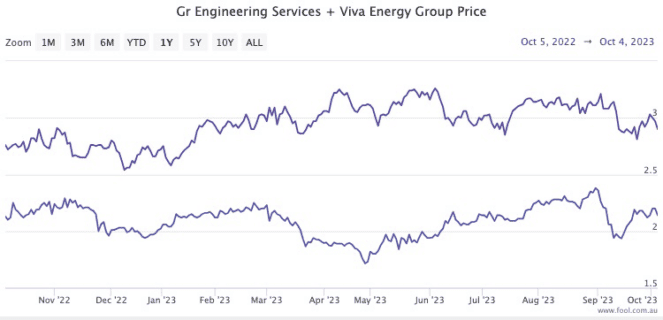

Again, you'll want to buy a diversified set of stocks. A trio that I can think of are Abacus Group (ASX: ABG), GR Engineering Services Ltd (ASX: GNG), and Viva Energy Group Ltd (ASX: VEA).

They play in distinct industries — real estate, engineering, and energy — and offer excellent dividend yields of 17.4% unfranked, 8.8% fully franked and 9.7% fully franked respectively.

If you can average out a yield of 10% per annum from a basket of such income stocks, then you can also rake in $18,205 each year.

The downside of this approach is the research required to overhaul the portfolio, and potential capital gains tax implications from selling the growth shares.

But the advantage might be that the passive income flow will be more predictable year to year.

You will want to seek personal advice to choose the best route for your circumstances.

Best of luck with your investments.