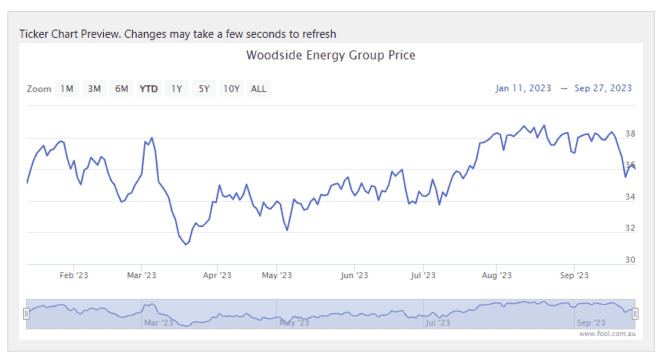

The Woodside Energy Group Ltd (ASX: WDS) share price is up 2.73% on Thursday, trading at $36.65.

The ASX 200 oil and gas giant is among many ASX energy shares rising today amid higher oil prices.

But the Federal Court has also dealt Woodside a blow today. Let's look into the details.

Woodside share price up due to higher oil prices

The Federal Court has ruled that Woodside's environmental plan for part of its mega Scarborough gas development was not legally approved and is thereby rendered invalid.

Federal Court judge Craig Colvin found that offshore energy regulator NOPSEMA did not legally approve the plan.

According to a report by abc.net.au, the problem is that NOPSEMA approved the plan with a condition that Woodside adequately consult traditional owners on the impact of surveying works on marine life.

Traditional owner Raelene Cooper claimed she wasn't adequately consulted. She also argued that NOPSEMA did not have the legal authority to impose the condition as part of its approval.

Cooper is concerned about how the surveying, which involves blasting air to the ocean floor, would impact sea life, including whales that carry indigenous songlines.

Woodside now has to resubmit an amended environmental plan, which will delay the testing.

The regulator must deem the new plan to be informed by adequate consultation as part of its approval.

For the Woodside share price, it appears higher oil prices are offsetting any impact of this news today.

According to Bloomberg, WTI crude oil and Brent crude oil prices rose to their highest levels in 2023.

The rise followed news of a greater-than-expected fall in United States oil inventories.

This comes on top of OPEC's planned production cuts, creating greater concern over the global supply and demand balance.

In other news, Woodside is paying out its interim dividend today. Investors will receive 80 US cents per share, fully franked.

This follows a record half-year profit for Woodside, which reported a 6% lift in net profit after tax (NPAT) to US$1.74 billion for 1H FY23.