You're highly unlikely to hear owners of Woodside Energy Group Ltd (ASX: WDS) shares complaining today.

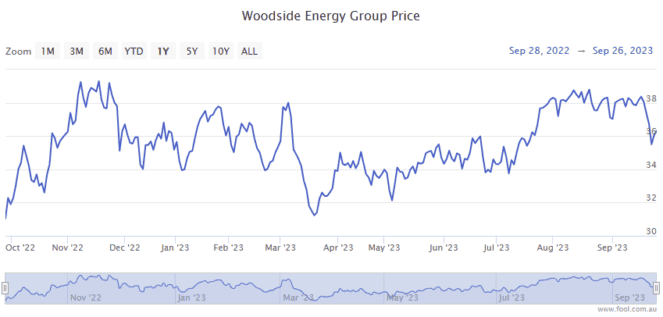

First, there's the healthy gain in the Woodside share price today with it up 2.5% to $36.57. That's largely thanks to the ongoing strength in global oil prices.

The brent crude oil price gained 2.7% overnight to US$96.52 per barrel. Oil prices are now trading at one-year highs.

Today is also the day eligible shareholders will see the interim dividend from the S&P/ASX 200 Index (ASX: XJO) oil and gas stock land in their bank accounts.

With Woodside's dividend reinvestment plan (DRP) suspended on 27 February, all eligible shareholders will be receiving a cash payout.

Here's what's happening.

Did you own Woodside shares on 30 August?

If you owned Woodside shares at market close on 30 August, you can expect that dividend payout today.

The stock traded ex-dividend on 31 August.

At its half-year results, the company reported net profit after tax (NPAT) of US$1.74 billion. That was up 6% from H1 2022 and represented a record first-half profit.

As for passive income, management declared a fully franked interim dividend of 80 US cents per share. That works out to a payout ratio of around 80% of NPAT. And it sees Woodside shares delivering a total payout of US$1.5 billion (AU$2.36 billion).

That came in on the top end of management's 50% to 80% target range.

"Our strong financial performance and our focus on disciplined capital management has enabled us to maintain our interim dividend payout ratio through the cycle," Woodside CEO Meg O'Neill said at the time.

Based on foreign currency exchange rates around the record date, eligible stockholders can expect to receive AU$1.243 per Woodside share.

At the current share price of $36.57, that equates to a yield of 3.4% from the interim dividend alone.

Adding in the final dividend of AU$2.154, paid on 5 April, Woodside shares trade on a juicy fully franked trailing yield of 9.3%.