There's an old adage in shares trading that says when the US market sneezes, the ASX catches a cold.

It basically means if Wall Street has a bad night, ASX 200 shares will have a bad next day.

And it's pretty reliable.

So, seeing the current divergence in the performance of US shares vs. ASX 200 shares is quite interesting.

Let's take a look.

US stocks vs. Australian shares in 2023

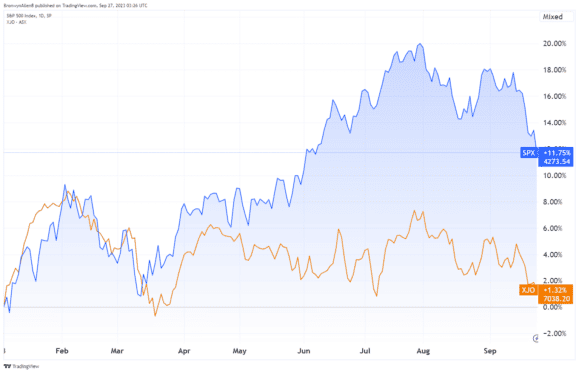

The following chart documents the year-to-date performance of the S&P 500 Index (SP: .INX) and S&P/ASX 200 Index (ASX: XJO) shares.

As you can see, a divergence began in May and has kept on going.

Over the course of 2023, the S&P 500 has risen 11.75% while ASX 200 shares have risen just 1.32%.

US stocks officially entered a new bull market back in June. At that point, the S&P 500 had ascended by more than 20% from its low point in October 2022, which is the definition of a bull run.

The Dow Jones Industrial Average Index (DJX: .DJI) commenced a new bull run in November 2022 and the Nasdaq Composite Index (NASDAQ: .IXIC) followed in May this year.

Commentators say US stocks are showing resilience in the face of higher inflation and interest rates.

So, why isn't the ASX 200 as resilient?

What's driving this differing performance?

Fool analyst Chris Copley offers his insights on why US stocks are doing better than ASX 200 shares in 2023.

Copley explains:

So far in 2023, it seems the S&P 500 has seen returns driven largely by just a handful of companies.

In particular, large cap technology businesses. So the likes of Apple, NVIDIA, Microsoft, Alphabet, and Tesla. Each of these businesses have significant exposure to the rising AI trend and have been buoyed by improving sentiment throughout the year.

As examples, Nvidia shares are up 193% in the year to date and Tesla stocks are up 126%.

Copley adds:

In contrast, the ASX 200 Index showed greater resilience particularly in early 2022 as commodity prices surged. The iron ore price, even after a resurgence in recent months remain materially below the peak seen early the prior year.

Whilst over time ASX and US shares tend to move in a similar direction, due to our markets' vastly different industry exposures, we can often see a divergence in returns — particularly over shorter periods of time.

Copley points out that ASX 200 shares fell by about 7% in 2022 while the S&P 500 fell by about 20%.