The S&P/ASX 200 Index (ASX: XJO) is climbing with vigour as we enter afternoon trading on Tuesday.

Amid a busy day for company reporting, the healthcare sector is leading the benchmark index higher, supported by pleasing results from CSL Limited (ASX: CSL) and Pro Medicus Limited (ASX: PME). All sectors bar one are in the green today, with real estate failing to get on board the gravy train.

The ASX 200 struggled to break above 7,310 points earlier today. However, that soon changed following the latest wage price data and the Reserve Bank of Australia minutes. Following this, the index found strength, now trading closer to 7,320 points, as pictured below.

XJO chart by TradingView

Here's a look at the data that preceded this afternoon's rally.

Have we seen the peak of wage growth?

The June consumer price index (CPI) figure of 6% year-on-year growth gave people some comfort when announced at the end of July. It showed a slowing in inflation compared to the prior quarter's scarier 7% posting.

However, the focus quickly shifts to where inflation and interest rates might be heading into September. After all, markets are forward-looking. Hence, the latest wage growth data released today provides some insight into what next month's rate call could shape up to be.

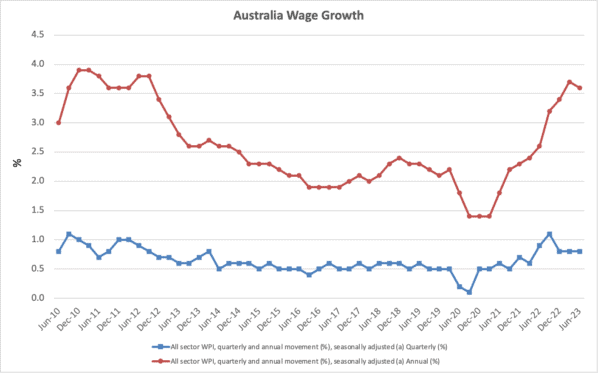

According to the Australian Bureau of Statistics, the wage price index rose 3.6% annually. While it's not the best news for Australian workers, it is lower than the 3.7% annual rise recorded in March — as shown in the chart below.

A single data point does not suggest a trend. Nonetheless, it is a step in the right direction if inflation is to reach the RBA's target band of 2% to 3% by around mid-2025.

Commenting on the data, ABS head of prices statistics Michelle Marquardt said:

For the third consecutive quarter, wages grew 0.8 per cent. Wage rises from regular June quarter salary reviews were higher than in the same period last year, as recent cost of living and labour market pressures were incorporated into organisation-wide decisions on wages.

Interestingly, the data showed fewer jobs with wage increases during the quarter. However, on average, the increases that were given were higher. This would suggest there are still pockets of short supply within the jobs market.

Music to the ears of investors and the ASX 200

Today's RBA minutes were another release that might be helping the market higher this afternoon. The publication gives a look into the rationale behind the Reserve Board of Australia's decision to leave the cash rate at 4.1% earlier this month.

The RBA considered raising the rate by 25 basis points or leaving it unchanged. When considering the argument to increase rates, the factors weighed included:

- Delayed response to persistent inflation could require a higher interest rate than otherwise needed

- Retaining a high employment rate would be more difficult under this scenario

- Australia's cash rate is notably lower than other countries despite inflation being at least as high

On the flip side, the RBA believes the full effects of its rate increases thus far have not been felt yet. In addition, members felt the recent information was 'encouraging', determining a 'credible path' back to its inflation target with the current cash rate.

Despite the unprecedented tightening cycle, the ASX 200 is up 5.34% in 2023.