In 2021, the Australian share market became an epicentre for investors hoping to cash in on the runaway price of lithium. While the battery material's price increased by nearly sixfold, so to did the value of many ASX lithium shares in this modern, electric version of a gold rush.

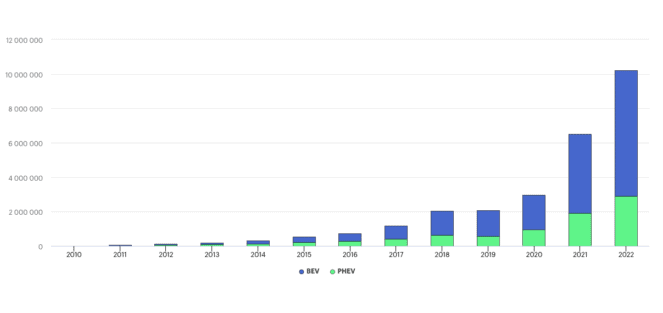

The excitement was not without reason. From 2020 to 2021, the number of battery electric and plug-in hybrid vehicles jumped 118%, as shown above, creating significantly more lithium demand. It became clear the supply and demand balance was out of whack, pressuring lithium prices to new heights.

Shifting expectations towards ASX lithium shares

During the mania, it felt like investors could throw a dart at a list of lithium companies, invest and make money — irrespective of the wide-ranging fundamentals.

However, tightening economic conditions and expanding supply have splashed cold water on the lithium price in 2023. As a result, the performance of lithium shares has been more diffused this year.

The team at Acorn Capital suggest "those frenzied days are over" for lithium investing. Instead, the Melbourne-based fund manager hints at investors needing to learn the new rules of old, to buy and hold winning ASX lithium shares moving forward.

So, how might someone pick the cream of the crop in ASX lithium shares as the landscape changes?

Not all lithium projects are the same

Not all lithium companies can be painted with the same brush. Several factors distinguish set some projects apart from others. However, few were concerned about the finer details while the lithium price soared.

In 2021, Sayona Mining Ltd (ASX: SYA) and Lake Resources N.L (ASX: LKE) were the two best-performing shares across the entire Australian share market. This was despite neither ASX lithium share having any meaningful revenues… nor do they now.

However, investors haven't been as keen to put their money behind either of these companies. Shares in both lithium hopefuls have tumbled 20% and 72%, respectively. Yet, others in the industry have experienced considerable share price strength, including:

- Latin Resources Ltd (ASX: LRS) up 285% year-to-date (YTD)

- Liontown Resources Ltd (ASX: LTR) up 123% YTD

- Patriot Battery Metals Inc (ASX: PMT) up 113% YTD

These three ASX lithium shares have something in common: they are all involved in hard-rock lithium projects. Hard-rock (spodumene) projects differ from brine or clay with their high lithium concentration and relative ease of mining.

In contrast, lithium brine projects — involving the extraction of salty lithium-rich fluid — can require hundreds of millions, if not billions, of dollars in capital to get off the ground.

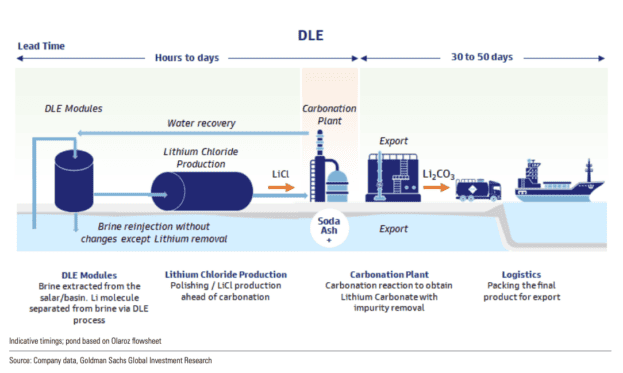

Direct lithium extraction (DLE) technology has been heralded as a possible workaround to the encumbering cost of brine projects. Lake Resources and Vulcan Energy Resources Ltd (ASX: VUL) are two ASX lithium shares hoping to use this new extraction process.

However, the technology has yet to be proven at a commercial scale. In Acorn Capital's view, the commercial usability of DLE could still be several decades away.

The third and final project type is lithium clay projects. Rather than a salty brine, lithium is found in clay mineralisations. While these deposits are often large, they come with the challenge of various mineralogies, requiring an assortment of processing techniques.

The new cookbook for success

Based on the insights of Acorn Capital, there are four important points to consider when investing in ASX lithium shares. In no particular order, these are as follows:

- Hard-rock projects could be best if hunting within the small and micro-cap space due to the lower upfront capital needed to become operational

- Consider the project's location in relation to the nearest refinery or port infrastructure. Large lithium deposits can go unmined if the company cannot economically reach a refinery or build its own

- Thick deposits are preferred over numerous narrow deposits due to the lower cost to mine

- Larger companies can be more appealing if investing in brine projects as they tend to be better funded than their smaller peers

As the lithium landscape becomes more competitive, these considerations could help separate the wheat from the chaff.

Not all ASX lithium shares are high-quality, and investors are beginning to invest accordingly.