Contrarian fund manager Allan Gray says investors are swapping ASX small-cap shares for the perceived safety of ASX large-cap shares due to market volatility caused by the choppy economy.

In Allan Gray's June quarterly report, managing director and chief investment officer Simon Mawhinney says this trend has been evident for several months.

ASX small-cap shares at 'lowest point since April 2000'

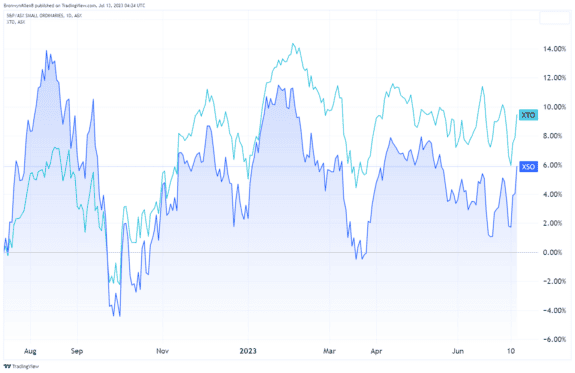

The chart below shows the 12-month performance of the S&P/ASX Small Ordinaries Index (ASX: XSO) compared to the S&P/ASX 100 Index (ASX: XTO).

Mawhinney says:

Over recent months, equity investors have gravitated to the perceived safety of large companies at the expense of 'riskier' smaller companies.

The Small Ordinaries Index is now at its lowest point relative to the ASX 100 Index since April 2000 when the Small Ordinaries Index first launched.

ASX small-cap shares typically have market capitalisations of a few hundred million up to $2 billion.

The Small Ordinaries Index represents 200 companies ranked 101-300 in the S&P/ASX 300 Index (ASX: XKO).

They are generally younger companies with greater growth prospects than the large caps.

However, their share prices tend to be much more volatile.

Mawhinney says:

While the Allan Gray Australia Equity strategy does own some large companies, it has a significant skew towards medium-sized and smaller companies.

It is here that we think the greatest upside potential exists.

In which small-caps is Allan Gray invested?

Among the top holdings (1% of the fund or more) of Allan Gray's Australia Equity Fund (Class A and B units) are ASX small-cap shares G8 Education Ltd (ASX: GEM) at $1.06 per share, Peet Ltd (ASX: PPC) at $1.21 per share, and Nufarm Ltd (ASX: NUF) at $5.33 per share.

The fund manager is also invested in several mid-cap shares, including Lendlease Group (ASX: LLC).

Allan Gray is a contrarian investment manager, which means it goes against 'the herd'.

It looks for opportunities that the market is missing or ignoring due to fear, complacency, or simply a terrible performance in recent years.

That's the case with Lendlease, and Mawhinney puts it pretty plainly:

Lendlease's share price performance has been woeful and makes the performance of the Small Ordinaries Index look like that of an artificial intelligence chip designer.

Allan Gray analyst Tim Morrison says Lendlease's returns to shareholders have been "spectacularly

poor". But the fund manager sees reasons for optimism, as my Fool colleague Tony reports.

The five biggest positions in the fund are large-cap shares Newcrest Mining Ltd (ASX: NCM), Woodside Energy Group Ltd (ASX: WDS), Alumina Limited (ASX: AWC), QBE Insurance Group Ltd (ASX: QBE), and Ansell Limited (ASX: ANN).