ANZ Group Holdings Ltd (ASX: ANZ) shares edged ahead on Wednesday.

At the final bell, the blue big four bank captured a green finish for its share price. Shares finished up 0.92% to $24.02, tracking roughly 8% below their 52-week high.

The slight rise is enough to outdo fellow banking majors, Westpac Banking Corp (ASX: WBC) and Commonwealth Bank of Australia (ASX: CBA), on a largely positive day for the sector.

Notably, the ANZ share price uptick coincided with a parliamentary hearing involving Australia's big four banks.

Competition aplenty if margins are the measure

Fronting up to Parliament House today, several key personnel from ANZ and National Australia Bank Ltd (ASX: NAB) answered questions to help examine how Australia's financial heavyweights are balancing the interests of all stakeholders.

Following recent record profits, Australia's biggest banks are now in the hot seat amid fears of inadequate competition. An era of consolidation has built the big four into a dominant force. It's one that would only grow strong with the merger of ANZ and the banking arm of Suncorp Group Ltd (ASX: SUN).

Despite this, ANZ CEO Shayne Elliott attested that the industry remains highly competitive, comparing it to a battle.

This is a war every single day to win home loan customers or other business for that matter.

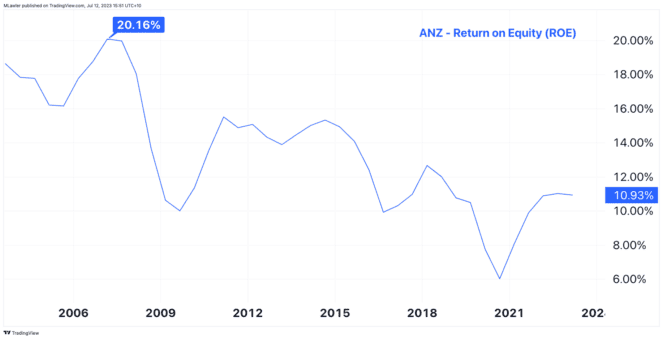

To fortify his stance, Elliott referenced the bank's declining return on equity (ROE), stating:

At the moment, the return on equity in banking in Australia is barely above the cost of capital – it's literally half what it used to be.

It's continued to fall pretty consistently over the long term and that is a result of fierce competition.

Looking at historical data, as shown below, Elliott's remarks on the dwindling ROE ring true — at least for ANZ. In addition, today's ANZ share price remains around the same level it traded at back in 2006.

At the same time, the bank's net interest margin (NIM) has narrowed from 2.87% in 2000 to 1.75% as of the latest half-year result.

Why would ANZ shares move higher then?

Given the minute gain, the movement in ANZ shares today could be attributed to several reasons.

Perhaps shareholders felt the CEO's remarks provided reasonable evidence of competition. The last thing ANZ shareholders want is tighter regulation, especially at a time when ANZ is vying for the opportunity to take Suncorp under its wing.

On top of this, Elliott supported the 3% serviceability buffer during today's hearing. CBA, Westpac, and NAB have hinted at a rejig for some of their customers. The stance could be seen as confidence in the strength of ANZ's loan book.

The ANZ share price is up 7.8% over the past year, making it the best performer of the big four.