One way to fight the effects of inflation is to invest in ASX 200 dividend shares that have a solid history of raising their payouts every year.

Choosing these types of ASX stocks gives you a good chance of growing your income every year, even if you don't buy any more shares, and that's pretty appealing — especially if you're in retirement.

But finding dividend shares within the S&P/ASX 200 Index (ASX: XJO) with that very long-term track record of increasing their dividends every year is actually pretty difficult.

It immediately wipes out some of the biggest dividend payers of the ASX 200, such as mining shares and energy shares, because their profits (and hence dividends) rely on fluctuating commodity prices.

But we've managed to find some examples for you.

Here are 5 ASX 200 dividend shares that have raised their dividends every year for at least 10 years.

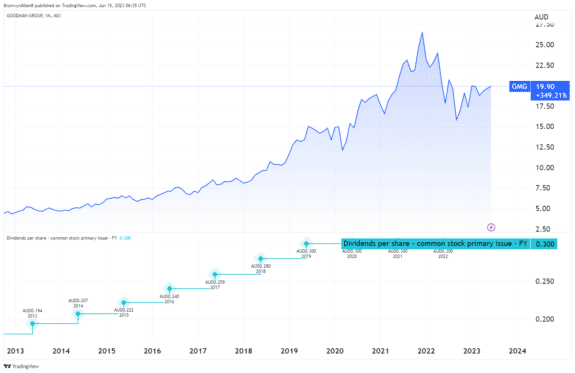

The dividend payments and capital growth of each stock is shown in the charts, courtesy Trading View.

Which ASX 200 dividend shares stand out most?

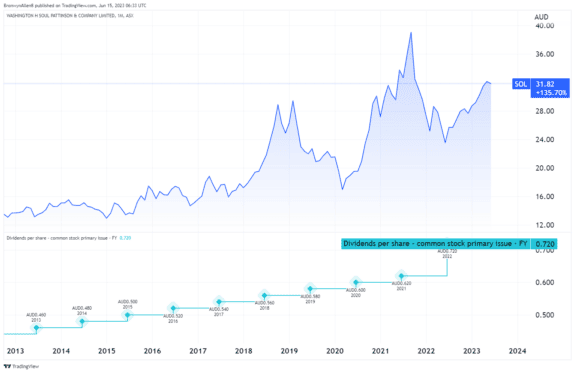

Washington H. Soul Pattinson and Co Ltd (ASX: SOL)

The absolute standout among ASX 200 dividend shares — in terms of a long track record for raising payments — is diversified investment house, Soul Patts.

As my Fool colleague Seb recently wrote, Soul Patts has raised its annual dividends every year since 2000.

Soul Patts paid 94 cents per share fully franked over the past 12 months.

The Soul Patts share price closed yesterday at $31.82.

That means Soul Patts shares are trading on a trailing dividend yield of 2.95%.

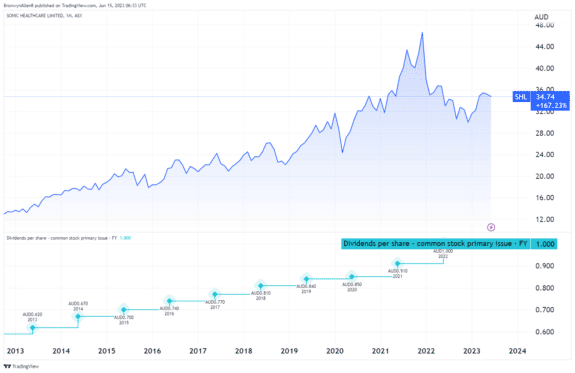

Sonic Healthcare Ltd (ASX: SHL)

Sonic Healthcare is a private global medical laboratory and pathology services operator. It has also increased its dividends for at least the past decade.

Sonic shares paid 102 cents per share fully franked over the past 12 months.

The Sonic Healthcare share price closed yesterday at $34.74.

That means this ASX 200 dividend share is trading on a trailing dividend yield of 2.94%.

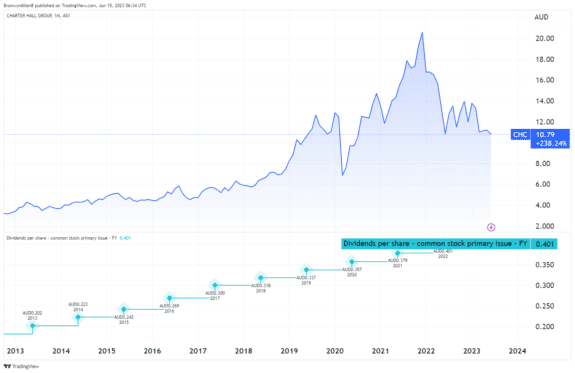

Charter Hall Group (ASX: CHC)

Charter Hall is an Australian property investment and funds management company. It also has a minimum decade-long history of raising dividends.

The ASX property share paid 41.31 cents per share with 45% franking over the past 12 months.

The Charter Hall share price closed on Thursday at $10.79.

That means this ASX 200 dividend share is trading on a trailing dividend yield of 3.8%.

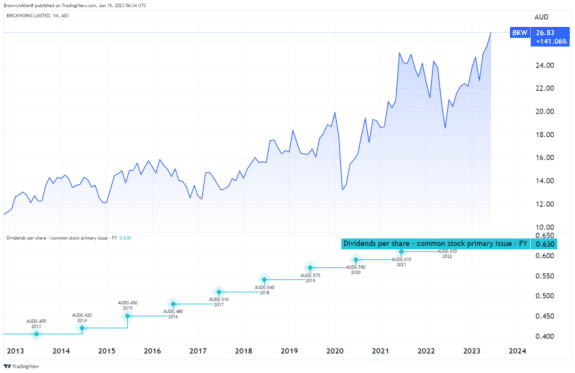

Brickworks Limited (ASX: BKW)

Brickworks is one of the world's largest and most diverse manufacturers of building products. It holds a 26% interest in our star ASX 200 dividend share, Soul Patts (and Soul Patts has a stake in Brickworks).

Brickworks shares paid 64 cents per share fully franked over the past 12 months.

The Brickworks share price finished the session yesterday at $26.83.

That means this ASX 200 dividend share is trading on a trailing dividend yield of 2.39%.

Goodman Group (ASX: GMG)

An honourable mention goes to real estate investment trust (REIT) Goodman Group. It has either raised or held dividends at the same level over the past minimum 10 years.

The stock paid 30 cents per share unfranked over the past 12 months.

The Goodman Group share price was trading at $19.90 at yesterday's close. That means this ASX 200 dividend share is trading on a trailing dividend yield of 1.5%.

Foolish takeaway

So, a 10 years-plus record of raising dividends is certainly impressive on its own.

The fact that the COVID-19 emergency didn't stop these ASX 200 dividend shares from upping their payments also speaks volumes about these companies' resilience.

We do need to point out that a long history of raising dividends doesn't guarantee this will continue.

But the boards of most companies seen as dividend shares deliberately want to nurture and protect this reputation.

It helps them retain and attract more income investors.

Once a company becomes established as a good dividend stock, there is much reluctance on the board's part to muck that up, even when profits fall.

So, there's some security in that if you're wanting to rely on your dividend income to fund your living costs.

We also need to note that some of the ASX 200 dividend shares featured above do not pay franking, or only pay partial franking. This can be an important consideration for tax reasons.

And as shown above, their dividend yields are not necessarily impressive. Indeed, following 12 interest rate rises, some of these yields are below what your money would earn in a savings account.

The highest savings rate in the market currently is 5.5%, according to RateCity.