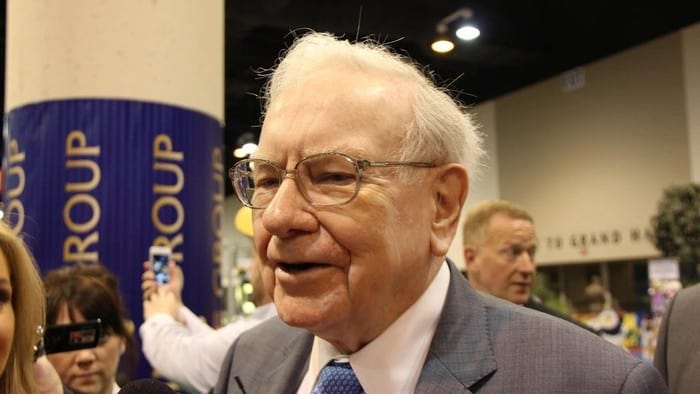

Two of the world's most famous investors are the leaders of Berkshire Hathaway (NYSE: BRK.B), Charlie Munger and Warren Buffett.

Given their track records over multiple decades, it certainly can pay to listen when they speak.

Especially when history has a tendency to repeat itself in financial markets. There's nothing that these nonagenarians haven't seen, so we can all learn a lot from them.

With that in mind, here are three quick tips from them to help you become a better ASX investor.

You make money by holding ASX shares, not buying and selling

When it comes to investing, Warren Buffett believes investors should hold for the long-term, rather than dip in and out. He once quipped that "if you aren't willing to own a stock for 10 years, don't even think about owning it for 10 minutes."

It is worth remembering that ASX shares don't move upwardly in a straight line, unfortunately. They bounce around, sometimes you're winning, sometimes you're losing. But if you have invested in a high-quality company, at a fair price, and you are patient, history shows that you should be rewarded.

On this topic, Charlie Munger once said: "The big money is not in the buying and the selling, but in the waiting."

Over time, an ASX share's valuation today is less likely to matter

As you might have noted above, I said "a fair price." Often ASX investors will want to buy an ASX share at the cheapest price they can get. Sometimes this means they miss out because a share price didn't fall to their ideal buy price before rebounding higher.

However, if you're investing with a long-term view, it is unlikely to make much difference to your returns if you bought in at $2.50 or $2.40. If the company is "wonderful," then it may be best to just accept a fair price, like Buffett once said:

It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Look for signs of sustainable competitive advantages

Another Warren Buffett tip to think about relates to investing in companies with sustainable competitive advantages.

Buying companies with these advantages, or moats, has played a key role in Berkshire Hathaway's investment success and there's nothing stopping you from following Buffett's lead. The Oracle of Omaha once said:

A truly great business must have an enduring 'moat' that protects excellent returns on invested capital.

While some competitive advantages are there for all to see, not all are immediately apparent. One sign that the two investors use to find harder-to-appreciate competitive advantages is the stability and width of a company's profit margin.

For example, if a company has a profit margin that's wider than average for years and years despite the presence of strong competition in their industry, there's a very good chance that there's a competitive advantage. So even if you can't identify exactly what that advantage is, be sure to note that there could be one in play.

There you go, three Warren Buffett tips that are easy to replicate and could be a big boost to your long-term returns.