ASX growth shares took a trouncing in 2022 as the global economy grappled with rapidly rising inflation and interest rates during a not-so-smooth COVID-19 recovery.

But could things be looking up?

A bunch of ASX growth shares are having a much better run in 2023. Perhaps it's time to dive back in?

Remember, the share market generally looks forward. It trades on future expectations rather than what's happening in the economy or market right now.

So, factors such as the expectation that we are close to the top of the interest rate cycle are influencing trading decisions today.

Let's investigate further.

What is a growth share?

ASX growth shares are companies that are expected to grow their revenues and profits faster than the market average.

They are typically younger businesses in the technology or biotechnology spaces, or other innovators disrupting traditional industries, such as ASX BNPL shares, ASX AI shares, and ASX cybersecurity shares.

Investors expect capital gains from their growth shares in lieu of dividends.

Growth companies typically reinvest their early revenues and profits instead of paying dividends. They often have a fair bit of debt, so they can be hit hardest by rising interest rates.

For investors, the chance of faster and higher rewards also comes with greater risks. Growth shares can be very volatile because investors are essentially betting that these unproven companies will succeed.

This is why growth shares typically tank during bear markets and/or tough economic times. Investors tend to flee to the safety of dividend-paying ASX value shares when they're feeling nervous.

That's exactly what happened in 2022. But are ASX investors returning to growth shares today?

Is it time to buy ASX growth shares?

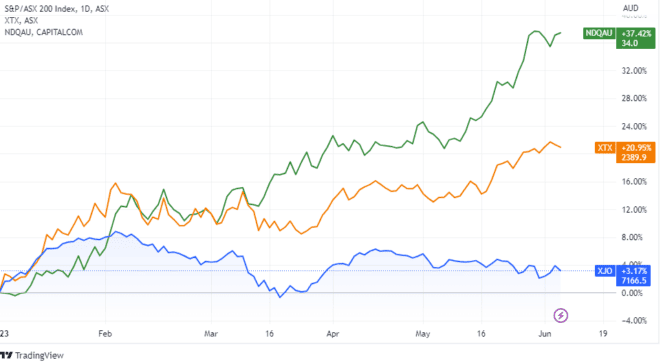

Let's compare the year-to-date performance of the S&P/ASX 200 Index (ASX: XJO), the S&P ASX All Technology Index (ASX: XTX), and the exchange-traded fund (ETF) Betashares Nasdaq 100 ETF (ASX: NDQ) as our proxy for the United States tech market, home to the world's biggest growth shares by far.

As you can see, the All Tech Index and the NDQ ETF are flogging the ASX 200 Index in 2023.

This may indicate that ASX investors are, indeed, returning to growth shares.

Which shares are outperforming?

Let's review the performance of five popular ASX growth shares in the year-to-date. The percentage growth of each stock is shown on the right side.

We've included tech shares WiseTech Global Ltd (ASX: WTC) and Xero Limited (ASX: XRO) of the former WAAAX group. We've also got ASX healthcare shares CSL Limited (ASX: CSL) and Cochlear Limited (ASX: COH). ASX consumer staple share A2 Milk Company Ltd (ASX: A2M) is along for the ride.

As you can see, it's a mixed-bag performance, indicating the need to do your research carefully.

All of these companies are growth shares, but they're in varying industries and sell different products.

For guidance on how to identify ASX growth shares in their infancy, check out our expert guide.