It has been a high-flying 12 months for Qantas Airways Limited (ASX: QAN) shares. After climbing 19% in the past year, the airline operator is a business that's hard to ignore.

Qantas has been a famous Australian brand for over a century, but does it make a great investment?

Here are the arguments for and against buying shares in the Flying Kangaroo right now:

Listen to Warren Buffett, please

By Tony Yoo: The world's most famous investor, Warren Buffett, explained the futility of investing in the aviation industry perfectly in his 2007 letter to Berkshire Hathaway Inc (NYSE: BRK.A) (NYSE: BRK.B) shareholders.

"The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money," he said.

"Think airlines."

Ever since the Wright brothers invented the plane, "a durable competitive advantage has proven elusive" for every carrier, Buffett added.

"The airline industry's demand for capital ever since that first flight has been insatiable. Investors have poured money into a bottomless pit, attracted by growth when they should have been repelled by it."

That's not to say he and Berkshire Hathaway haven't invested in aviation over the decades. But he has, more often than not, lost money in doing so.

But not our Qantas, I hear you say! It operates as the dominant player in a duopoly in Australia – how can you go wrong?

Remembering Buffett's advice about how much capital is required to maintain an airline business, it's worth noting that Qantas has a ridiculously ageing fleet.

| Aircraft | Number that Qantas flies | Average age (years) | Qantas' rank |

| Airbus A330 | 25 | 15.9 | 121 of 141 airlines |

| Airbus A380 | 8 | 13.4 | 9 of 10 |

| Boeing 737 NG/Max | 75 | 14.9 | 179 of 294 |

| Boeing 787 | 11 | 4.4 | 23 of 73 |

According to airfleets.net, the average Qantas plane is 14 years old now.

Looking specifically at the Boeing Co (NYSE: BA) 737 NG/Max and the Airbus SE (EPA: AIR) A330 that dominate its fleet, they average 14.9 and 15.9 years old respectively.

Out of 141 airlines that fly the A330, it ranks 121 for age. Of the 294 airlines that use the 737 NG/Max, Qantas operates the 179th oldest fleet.

This is horrifying stuff.

New chief executive Vanessa Hudson will have to spend enormous amounts of capital expenditure in the coming years to bring the fleet back into shape.

This is something that seems to be glossed over in the Qantas board's canonisation of the outgoing chief Alan Joyce. He has inflated profits by not spending enough on maintaining a modern fleet of planes.

I am not buying Qantas shares as a part of any long-term investment plan.

Motley Fool contributor Tony Yoo does not own shares in Qantas Airways Limited.

Qantas shares could be the ticket for returns

By Tristan Harrison: The Qantas share price has outperformed the S&P/ASX 200 Index (ASX: XJO) in 2023 to date and I think that can continue.

The ASX airline share has dipped since the start of May, making it cheaper for investors to buy. This decline may have coincided with the news that the CEO, Alan Joyce, is leaving and the reins are being taken over by the chief financial officer, Vanessa Hudson. I think there could be a lot of continuity with the new leader coming from within the Qantas ranks.

It's been a few months since the last trading update, but when the company announced its FY23 half-year result it said that travel demand is expected to "remain strong throughout FY23 and into FY24".

I think the return of tourists and Australia's growing population will translate into more people using planes, which would be promising for Qantas earnings and the Qantas share price.

The valuation seems very reasonable to me. According to Commsec, it's priced at just 7 times FY23's estimated earnings and 6 times FY24's estimated earnings. I think the Qantas share price could easily be valued 20% higher than it is today and it would still be on a single-digit price-to-earnings (P/E) ratio.

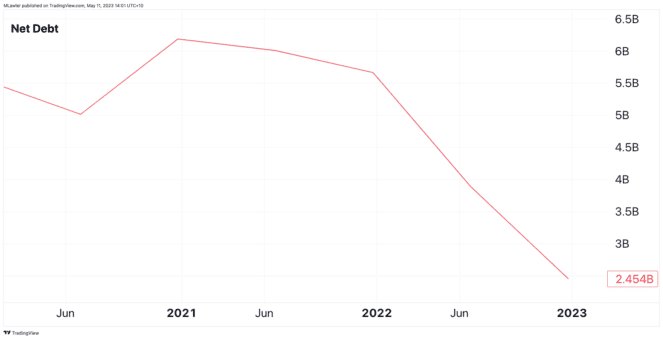

The improving balance sheet situation, as demonstrated above, could enable the business to start paying dividends in FY24 or FY25. Remember, Qantas already launched a share buyback.

By FY25, Commsec numbers suggest the ASX airline share could be paying an annual dividend per share of 21 cents. That's a 3.3% dividend yield excluding any franking credits.

Motley Fool contributor Tristan Harrison does not own shares in Qantas Airways Limited.