Over decades, Warren Buffett has constructed a portfolio of some of the greatest long-term compounders in modern America. The monumental success has attracted countless aspiring investors who wish to emulate his vast fortunes by uncovering Buffettesque investments.

The legendary stock picker has amassed a fortune of more than US$100 billion by diligently applying a value investing approach at Berkshire Hathaway — the conglomerate holding company of which he is chair and CEO.

But, what if you wanted to build a similar portfolio with shares from within the S&P/ASX 200 Index (ASX: XJO)?

Whether the reason behind a domestic desire is grounded in taxes, fees, area of competence, or something else entirely — here's how I would go about building an Aussie version of the Berkshire portfolio.

What does Warren Buffett hold in the Berkshire portfolio?

The initial step in taking inspiration from an existing portfolio is to first find the blueprint. Fortunately, this isn't difficult due to Berkshire Hathaway being required to report its holdings to the US Securities and Exchange Commission on a regular basis.

Based on currently available information (as of 4 April 2023), the US$682 billion investment company holds the following listed investments.

| Top 20 Berkshire Hathaway holdings | Percent of portfolio |

| Apple Inc (NASDAQ: AAPL) | 44.3% |

| Bank of America Corp (NYSE: BAC) | 8.7% |

| Chevron Corporation (NYSE: CVX) | 8.0% |

| American Express Company (NYSE: AXP) | 7.3% |

| Coca-Cola Co (NYSE: KO) | 7.3% |

| Occidental Petroleum Corporation (NYSE: OXY) | 3.9% |

| Kraft Heinz Co (NASDAQ: KHC) | 3.7% |

| Moody's Corp (NYSE: MCO) | 2.2% |

| Activision Blizzard Inc (NASDAQ: ATVI) | 1.3% |

| BYD | 1.1% |

| HP Inc (NYSE: HPQ) | 1.0% |

| Itochu Corp | 0.9% |

| Davita Inc (NYSE: DVA) | 0.9% |

| Verisign Inc (NASDAQ: VRSN) | 0.8% |

| Citigroup Inc (NYSE: C) | 0.8% |

| Kroger Co (NYSE: KR) | 0.7% |

| Paramount Global (NASDAQ: PARA) | 0.6% |

| Visa Inc (NYSE: V) | 0.5% |

It should be noted that the above list does not include businesses that are solely owned by Berkshire Hathaway. Examples of such companies are GEICO and Berkshire Hathaway Primary Group, among many others.

Berkshire's top 20 largest positions make up 94% of the total portfolio. I have disregarded the 34 smaller investments given their near-negligible overall impact.

Furthermore, owning 54 positions as an individual investor is a daunting and unnecessary undertaking in my opinion. Hence, my objective of an Aussie alternative will be centred around the 20 main contributors.

Building an alternative with ASX 200 shares

Now that we know what we're aiming for, it's time I put in the leg work and find worthy ASX-listed replacements… which is easier said than done in some cases.

Nevertheless, here's how I would apply the fundamentals of the Warren Buffett curated portfolio to stocks residing in the land down under.

Structuring the portfolio

Buffett is quoted as saying, "Diversification is a protection against ignorance. It makes very little sense for those who know what they're doing."

It appears the Oracle from Omaha practices as he preaches — holding roughly 75% of Berkshire's portfolio in just five companies.

Selecting the top 5 heavy lifters

It goes without saying, the ASX 200 stand-ins need to be some of the highest-quality listed businesses Australia can offer to earn such a substantial weighting. Especially the top holding, Apple, which alone accounts for a 44.3% portion.

In my opinion, there simply isn't an ASX share of the same calibre as the US tech giant. It wields the strongest and most recognisable brand on the planet; is highly profitable; attracts wealthy customers; and sells extremely sticky products and services.

However, consider the graphic below:

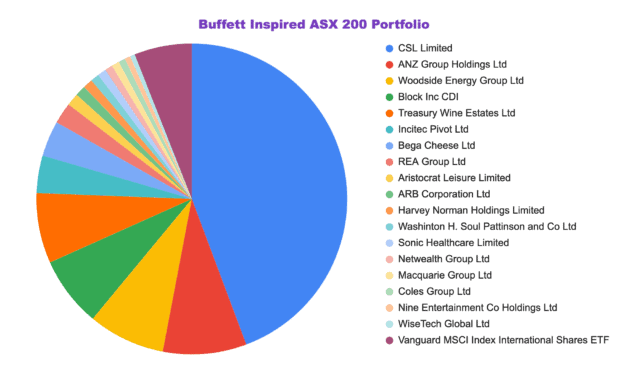

As shown above, I landed on CSL Limited (ASX: CSL) as the most fitting Australian substitute for Apple. While the two companies are worlds apart in what they do, there are similiarities. The overlap exists in their hard-to-disrupt nature, thick profit margins, diverse product offerings, and future growth potential.

The second-largest position I would award to ANZ Group Holdings Ltd (ASX: ANZ). Like Bank of America, ANZ has a similar degree of operating leverage to its peers, yet trades at a discounted earnings multiple to the other big four banks.

Moving along, the third, fourth, and fifth largest positions would go to Woodside Energy Group Ltd (ASX: WDS), Block Inc CDI (ASX: SQ2), and Treasury Wine Estates Ltd (ASX: TWE). The reasons are as follows:

- Woodside holds the financial firepower to conduct share buybacks if it so chooses. A likely reason for Warren Buffett adding Chevron to the Berkshire portfolio.

- Block, formerly Square, is pioneering modern financial solutions with a loyal and growing customer base. Not too dissimilar to the origins of the American Express card in the late 1950s.

- Treasury Wine Estates owns a variety of established and recognisable brands, commanding premium margins over its peers. The ASX 200 alcoholic beverage maker offers a dividend yield of 2.6%.

That's three-quarters complete already.

What about the rest?

There are still another 15 ASX companies as part of this investing mimicry. Though, I would probably need to write a book to explain the reasoning behind all the selections. So, let's concentrate on one of the more obscure picks.

In place of Occidental Petroleum, I would opt for the fertiliser and chemicals manufacturer — Incitec Pivot Ltd (ASX: IPL). Both companies operate in cyclic industries but have demonstrated hefty operating leverage in the past year.

Additionally, both companies are trading on earnings multiples of six times or less. If the commodities boom can be sustained for even a few more years, current valuations might appear cheap in hindsight. That's a frame of thinking that might explain Warren Buffett's large positions in Occidental and Chevron.

Which Warren Buffett picks I think are irreplaceable

I'd like to think I've picked a handful of reasonable alternatives among our ASX 200 shares. However, there are some US counterparts that I'd insist are simply unmatchable in what they offer investors.

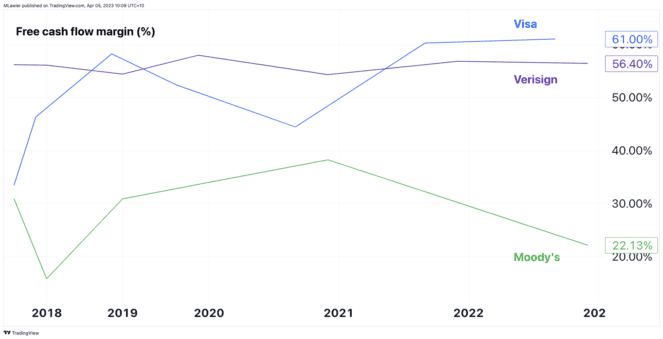

From my perspective, companies that fall into this category include Moody's, Verisign, and Visa. All three command breathtakingly wide moats, mindblowing free cash flows (see above), and returns on equity that would make your head spin.

For those reasons, if I were to make a few exceptions from staying within the confines of Australia, those would be the three Warren Buffett finds I'd happily duplicate.