Local investors might be wondering where they can get a piece of Netflix Inc (NASDAQ: NFLX) shares on the ASX today.

Shares in the on-demand streaming service took flight in after-hours trading as investors flicked through the company's fourth-quarter report. A mostly positive reception pushed Netflix shares 7.1% higher to $338.25 apiece, taking its 6-month gain to 56%.

Let's take a look at what went down and one way of getting exposure via the ASX.

Eyes set on better times

If you were to only look at a few key metrics from Netflix's latest result, you might wonder what everyone is getting so excited about.

In the Q4 2022 letter, it quickly becomes clear that the final three months of the year weren't quite a homerun:

- Revenue grew increased 1.9% year on year to US$7,852 million

- Operation income fell 13% to US$550 million

- Operating margin decreased from 8.2% to 7%

- Net income plummeted 91% to US$55 million

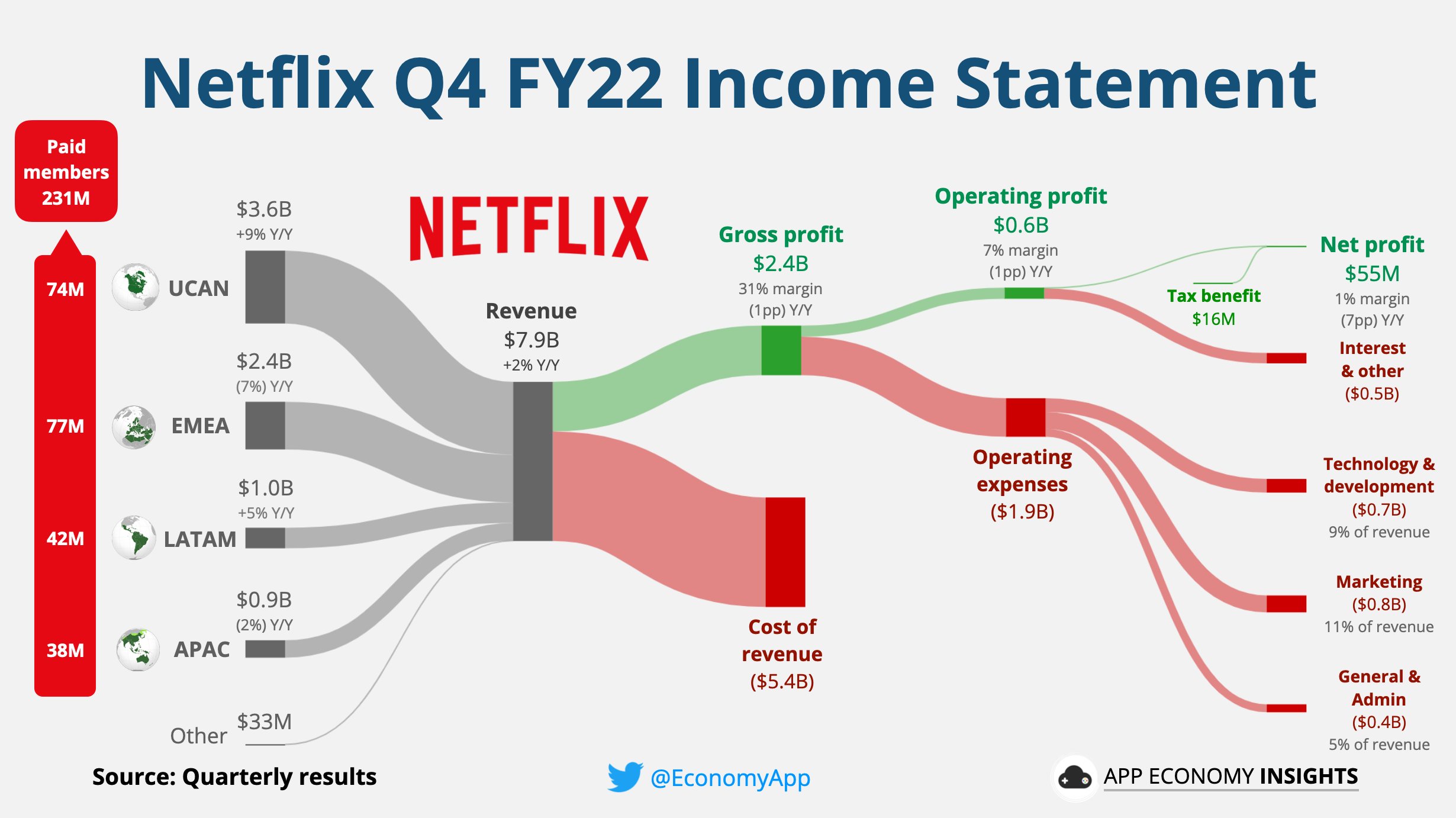

An in-depth breakdown of the financials is shown below, courtesy of App Economy Insights.

Although, a positive to take from the quarter include the launch of Netflix's ad-supported plan. While the company did not specify the exact details of its success so far, it is possible it partly fuelled the 7.7 million net member additions in Q4 — beating analyst estimates of 4.6 million.

The strong period for additions brought the streaming giant's total global membership base to 230.75 million at the end of 2022. Yet another feather in the company's cap bolstering the Netflix share price.

Where the enthusiasm really begins to shine is in the forward outlook. According to its release, Netflix intends to reaccelerate revenue growth in 2023.

The catalysts for this growth reinvigoration are expected to be the new ad-supported offering and the rolling out of paid sharing — the latter being a way for Netflix to monetise the popularity of password sharing.

Lastly, management is expecting to land US$3 billion in free cash flow in 2023. The tantalising proposition would be almost double the free cash flow achieved in 2022.

How can ASX investors get in on Netflix shares?

The easiest and most direct way to obtain Netflix shares as an Australian is to create an international trading account via a supporting broker. However, that can come with higher fees as the trade is not handled on the ASX.

Another way to gain some exposure to the Netflix share price via the ASX is to invest in the company through an exchange-traded fund (ETF). A popular option is the Betashares Nasdaq 100 ETF (ASX: NDQ), which tracks the performance of the 100 largest non-financial companies on the Nasdaq.

Be aware that while Netflix is the 17th largest position in the ETF, it's still only a minute 1.2% weighting. The largest weightings are dominated by Apple Inc (NASDAQ: AAPL), Microsoft Corp (NASDAQ: MSFT), and Amazon.com Inc (NASDAQ: AMZN).