A share market expert is predicting a Santa rally could still be on the way this year.

CNBC TV personality and expert stock picker Jim Cramer believes "Christmas is not going to be cancelled for Wall Street" this year.

So could this impact the S&P/ASX 200 Index (ASX: XJO) too? Let's take a look.

What is a Santa rally?

Firstly, a Santa rally is a trend of the stock markets to outperform in the lead-up to Christmas, or just after Christmas.

A Santa rally generally is meant to take place in either the five days leading up to Christmas. Or, the last five trading days of the year.

When to buy?

A Santa rally in the United States could still be on the way, according to CNBC's Jim Cramer. As a stock market devotee, Cramer delivered average annual returns of 24% over 14 years between 1988 to 2000.

Cramer said the best time to buy could be this Thursday, citing charts from 60-year trading veteran Larry Williams. Williams is known for trading his own money live at seminars around the world.

The charts suggest the market "may have just entered a seasonal sweet spot," Cramer said. He added:

The charts, as interpreted by Larry Williams, suggest that Christmas is not going to be cancelled for Wall Street – he thinks we still have a Santa Claus rally coming, and the ideal time to buy is sometime around this Thursday.

I know it's hard to believe that the market's ready to run, but that's how it always is with Larry's calls. Although it's possible this year will be different, historically, betting against him has been a real bad strategy.

Could the Santa rally impact the ASX 200?

The ASX 200 could follow in the footsteps of Wall Street with a Santa rally, according to City Index senior market analyst Matt Simpson.

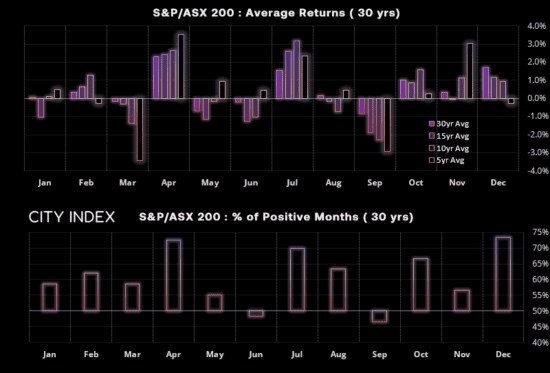

Simpson highlighted that the ASX 200 has returned an average of 1.7% in December over the last 30 years. In comments provided to The Motley Fool, he said:

If Wall Street can muster up a rally into the back of the year, so can the ASX 200.

December usually generates excitement of a 'Santa's rally', which can be justified with an average return of 1.7% in December over the past 30-years. Yet in recent years this positive expectancy has diminished, with an average return of 0.9% over the past 10 years and -2.6% over the past 5 years.

In a nutshell, I think we can see a bounce on the ASX from here but remain sceptical of it breaking to new highs. We'll take it if it does, but it would be a bonus at this point.