This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

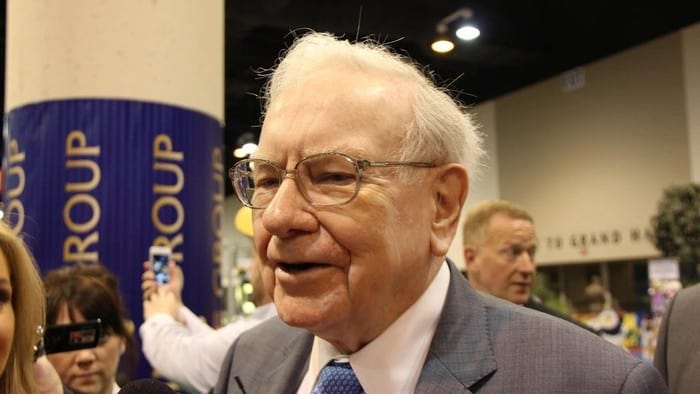

Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), the conglomerate run by legendary investor Warren Buffett, released its third-quarter earnings on Saturday, reporting a solid operating profit of roughly $7.76 billion.

The report also gave Berkshire watchers some insight into third-quarter investing activity by Buffett and his investing team.

Berkshire runs a massive equities portfolio -- roughly $328 billion -- and given the company's success, it's never a bad idea to look at stocks the company is buying and selling. Here's what we know so far about some of the moves Berkshire made between August and September.

A net buyer of stocks

Despite the broader market's rocky performance in the third quarter, with the S&P 500 falling about 5%, Buffett and Berkshire remained active, purchasing about $9 billion of equities, according to its cash flow statement. Berkshire also sold roughly $5.3 billion of equities in the quarter, making the company a net buyer of about $3.7 billion in stocks.

While we don't know exactly what Berkshire was buying and selling just yet, we can get clues from Berkshire's quarterly report and other filings made during the third quarter. For instance, we know Berkshire added to its stake in the large U.S. oil producer Occidental Petroleum, which is not a huge surprise considering Buffett and Berkshire have been heavily buying shares all year.

Although Berkshire was a net buyer of stocks in the third quarter, it reported that its cost basis for all of its stocks fell from $149.7 billion at the end of the second quarter to $142.3 billion at the end of the third. This is likely because Berkshire's stake in Occidental topped 20% during the quarter, so it's now using the equity accounting method to report that position. Companies typically use the equity method when they hold significant control of another business -- often 20%. Berkshire's equity method holdings jumped about $11.2 billion in the third quarter, which is similar to the size of its position in Occidental as of Sept. 30.

Berkshire also reports the cost basis of stocks it owns in different sectors, which can give us an idea of whether it was a net seller or buyer of stocks in that sector. Notably, its cost basis in the banking, insurance, and finance sectors fell about $4.7 billion in the quarter, so it looks like this is where Berkshire did most of its selling.

Berkshire also increased its sizable cash position by about $3.6 billion in the quarter to $109 billion and conducted share repurchases of about $1 billion.

Stay tuned

While Buffett and Berkshire weren't buying the dip as aggressively as they did in the first quarter of the year, it will still be interesting to see what moves they ultimately made in a rough three months for the broader market.

We'll soon get more information about exactly which stocks Berkshire bought and sold in the third quarter when the company updates its holdings in its quarterly 13F filing. Institutional investment managers are required to file this form no later than 45 days after the third quarter ends. Berkshire usually does so at the end of that window, so look for it to be released to the public on Nov. 14.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.