This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

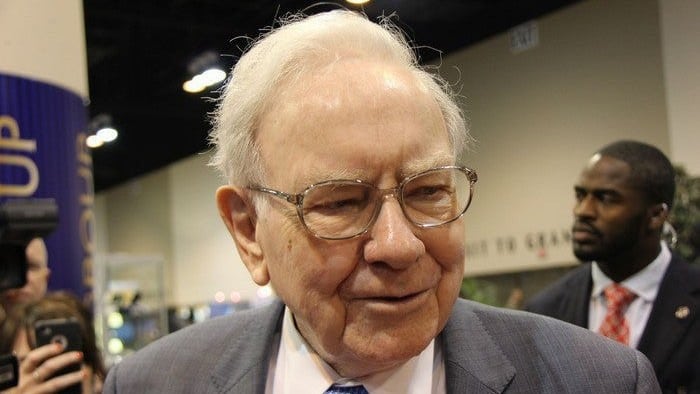

Investors from all woks of life tend to follow the teachings and philosophies of legendary investor Warren Buffett. After all, Buffett is not only considered to be one of the best investors ever, but he's also one of the richest people in the world, so he's got the results to back it up.

Buffett has achieved most of his success from his many years running Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), which he acquired in the mid-1960s. Since then, Buffett has turned Berkshire into one of the largest companies in the world, operating in the mortgage, energy, railroad, and insurance sectors.

Berkshire also happens to run a colossal roughly $328 billion-plus equities portfolio, where it buys and sells individual stocks. This is what I am referring to when I am talking about Buffett's portfolio. And as one might imagine, Berkshire's portfolio is very different from the average individual investor's portfolio. Here's why.

The basics

Buffett is always positioning Berkshire with a long-term investing strategy, even though he is now 91 years old. That's because even when he eventually retires, he wants Berkshire to continue on forever. Buffett often says his goal is to invest in companies that he never has to sell.

While we always preach a long-term investing strategy at The Motley Fool, some individual investors might be older and therefore might be thinking about pulling their investments out for retirement soon. Therefore, these people's view might not be so long term. As an individual, long-term investing is incredibly important, but you also have to take stock of where you're at in life.

Berkshire also tends to keep a ton of cash in its portfolio, with more than $105 billion of cash at the end of the second quarter. In fact, Berkshire's policy is to always hold at least $30 billion in cash and cash equivalents in its portfolio to prepare for extreme downside scenarios. That way, investors sleep much better at night.

As an individual investor, especially if you are younger, most financial experts would tell you to be more aggressive over a longer time horizon because you need to build adequate savings for when you retire. In fact, even the old 60/40 investing strategy, where you invest 60% of your portfolio in stocks and 40% in bonds, has come under scrutiny, with many believing it's not aggressive enough to accumulate enough savings to get you through retirement. Again, it's important to consider where you're at in life.

Berkshire is more concentrated

When considering an investment strategy, you've probably heard the expression of not putting all of your eggs in one basket. But Buffett and Berkshire throw this out the window. In fact, Berkshire's portfolio recently had roughly 77% of its equities portfolio in just six stocks, including Apple, Bank of America, and Chevron.

Buffett has famously said in the past that stock diversification does not make a lot of sense if you actually know what you are doing as an investor. "It is a protection against ignorance," he added.

While the words may sound harsh, Buffett is actually not preaching against diversification. He is simply saying that if you spend your entire week studying stocks like they do at Berkshire and have the company's resources, there's no reason you can't do enough due diligence to get to a point where you know you will be right over the long term. Obviously, everyone makes mistakes, but I think you get the point.

However, if you work a full-time job that isn't in the world of investing or have children or other priorities, you might not have enough time to do the necessary amount of research on stocks. In this case, investing in a large basket of stocks or index funds makes sense.

Learn from Buffett, but don't necessarily copy him

You should definitely study the way Buffett and Berkshire invest. You should even follow the stocks they buy and sell because you might come across a great opportunity. But you don't need to copy every move or strategy that Berkshire and Buffett make, and you probably shouldn't.

Remember, Berkshire is investing hundreds of billions on behalf of a large group of shareholders it needs to protect. You are investing for yourself, perhaps your family, and planning for your retirement.

So, it's OK to invest in a large pool of stocks and base your strategy on where you are at in life. If you're young, you might find yourself investing more aggressively than Buffett and Berkshire. If you are nearing retirement, perhaps you are being more conservative. Ultimately, Buffett can influence your investing strategy, but he doesn't have to define it.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.