This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

With the 21% drop in the market-tracking SPDR S&P 500 ETF Trust (NYSEMKT: SPY) this year so far, we're definitely in a bear market, and that means risks to your portfolio are as tangible as ever. Most investors recognize that in such a market, it's possible to lose a lot of money really quickly if you let panic take the wheel and make your investing decisions for you.

But there's a far more insidious way to lose a lot of money in a bear market: making decisions that feel good in the moment, but which are actually kryptonite for your portfolio's long-term value. Let's get familiarized with a trio of these wolves in sheep's clothing so that you'll know what kind of ill-advised moves to avoid.

1. Selling your stocks after a particularly bad day for returns

When you've been looking at your stocks falling for days or weeks on end during a bear market, it might not take much beyond an ordinary daily decline to trigger a strong desire to sell and cut your losses.

Selling is a move that's always available to you, and it offers the promise of getting some money back immediately while also guarding against the pain of your shares falling even further, which can often seem like an inevitable and permanent trend. It reduces your anxiety promptly, and it feels good to sell your laggards, if only so that you stop seeing the damage accumulate in your portfolio overview. And it's often a terrible financial decision, even though it might help you sleep at night.

You're not really investing for the future if you don't have your eyes on the long-term potential of your companies to appreciate in value. To be clear, if you have a strong inclination to liquidate your position in a stock, you should be able to articulate why and how your long-term investing thesis for that stock has changed before you proceed with a sale.

For example, with a falling stock like Aurora Cannabis (NASDAQ: ACB), you might say something about how its gross margin is weakening over time despite its efforts to the contrary, which casts doubt on its ability to profitably compete. That phenomenon isn't at all related to the stock's daily gyrations, but it probably means the company won't be worth a vast amount more until at least a while after margins start to widen again, if they ever do.

If your rationale for selling a stock is just that its share price is falling, that's just fear talking, and it isn't worth listening to.

2. Buying stocks just because they're rising when nothing else is

Another way to lose money in a bear market is to invest in stocks that are going up when most other investments are going down. It feels smart to find underappreciated businesses that are sticking it to the overall market. And if your investment sees some early success, it's a confirmation of your wiser-than-the-market feeling.

But countertrend price movements are a poor reason to buy a company's shares, especially if they're the only data points you're using to justify your decision. There are a lot of things that can make a stock go up. Some of those things are relevant to the company's ability to generate earnings over time, and others aren't. If you can't appreciate why a business is likely to keep outperforming its peers, you probably don't have an investment thesis for it at all.

So don't be captured by the illusion of outperformance during a bear market. It could yield some quick gains, but if you don't have any analysis to lean on when times get tougher, there's a good chance you'll just quit your position and lose your money.

3. Buying on the dip with stocks you know nothing about

During bear markets, it's perpetually tempting to buy on the dip, especially when you're thinking about household names that you expect to be around forever. Buying a stock when other people are broadly sour on it makes you feel special, and it's a particularly intoxicating brew for people with a contrarian bent.

The trouble is, there's no way of knowing that the "dip" is just a short-term inconvenience for shareholders. It's entirely possible that the stock will never recover to its prior glory.

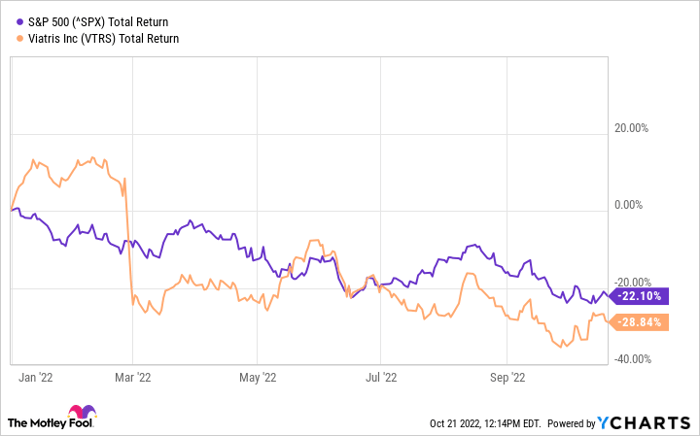

Take the recent dip in the generic drug manufacturer Viatris (NASDAQ: VTRS) for example:

Data by YCharts.

The fall in its share price was caused by the announcement of its fourth-quarter earnings, when it also announced that it was selling off a major division of its business. In other words, it will likely bring in less revenue for a while after the transaction closes. If you just "bought the dip" without recognizing that the company's growth potential is somewhat lower as a result of the deal, you're liable to be unhappily surprised down the line when Viatris' revenue lags your expectations.

Once again, having an investing thesis you can articulate and sticking to it is the way to guard against this money-losing tendency. When you're thinking about buying on the dip, think about what made the market dump the stock in the first place, and consider whether the company's fundamentals and long-term value proposition are still sound. If people were selling, at least some of them thought that the situation wasn't going to improve, and they could be right. But you won't know for sure what you even think until you do the due diligence yourself.

One last thing: Don't let your friends, relatives, co-workers, favorite podcasters, pets, or anyone else cajole you into buying on the dip. Peer pressure might be tough to resist, but your financial future will be better if you do, whether there's a bear market or not.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.