This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Investors are always searching for the next game-changing company that could generate strong long-term returns. That hasn't been easy this year because the technology sector is mired in a bear market, and sentiment toward innovative companies is broadly pessimistic, which tends to overshadow their potential.

A looming economic slowdown is the reason for the negativity, as rising inflation is pushing interest rates higher and squeezing consumers' wallets. But some companies have been less impacted by this -- particularly those that sell their products and services to other businesses.

Snowflake (NYSE: SNOW) is one of them. Its stock is down 53% in 2022 so far, but its revenue continues to soar, which suggests this might be a great opportunity to buy. After all, Snowflake stock is owned by Warren Buffett's Berkshire Hathaway Inc. (NYSE: BRKB), and he's widely regarded as one of the best long-term investors in the world.

Enter the Data Cloud

Snowflake is taking advantage of the digital revolution in the corporate sector. Companies are shifting their operations online at a rapid pace using cloud technology, and they're generating mountains of data that might seem messy and disorganized at face value, but that actually contains valuable underlying insights when it's analyzed effectively.

Large organizations sometimes use multiple providers of cloud services to facilitate their digital transformations, including Amazon.com, Inc.(NASDAQ: AMZN) Web Services, Microsoft Corporation (NASDAQ: MSFT) Azure, and Alphabet Inc. (NASDAQ: GOOGL)'s Google Cloud. But that often means their data is fragmented because it's siloed across several platforms. Snowflake has created the Data Cloud, which is designed to unify all of it for maximum visibility.

The three aforementioned cloud providers are now all tightly integrated with Snowflake because their customers benefit from the platform. In circumstances where they need to share important data with a business partner that operates on a different cloud provider than their own, for example, Snowflake is a game changer.

Plus, the company has built an innovative data marketplace where Snowflake customers can buy, sell, and exchange data with one another, adding a new dimension to the benefits of being inside its ecosystem.

Snowflake's growth is soaring

In the second quarter of fiscal 2023 (ended July 31), Snowflake had 6,808 total customers. But the subset of those customers spending at least $1 million with the company more than doubled to 246 compared to the year-ago period. It highlights the rapidly growing need for Snowflake's platform.

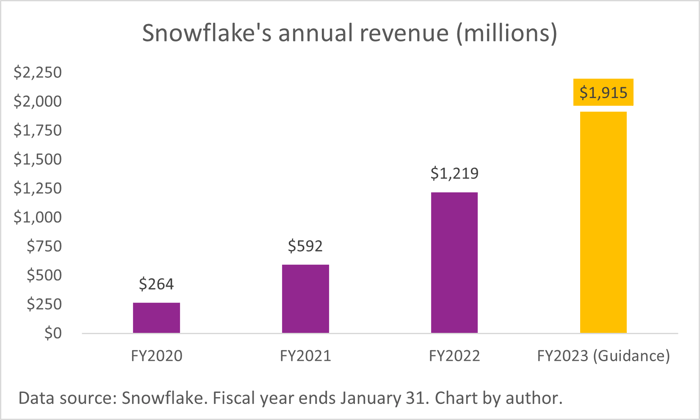

Snowflake's revenue soared 83% year over year during the quarter, reaching $497 million. The strong result prompted the company to slightly increase its full-year guidance for fiscal 2023, and it now expects to generate a total of $1.915 billion in sales.

Zooming out, the big picture shows that if it delivers on that estimate, it will have grown its revenue at a compound annual rate of 93% since fiscal 2020.

Therefore, even in the face of an economic slowdown, Snowflake's business continues to rapidly expand. This is further supported by the fact it has hired nearly 1,000 additional staff during the current fiscal year, while many other companies in the technology sector have been slashing their head counts.

Snowflake isn't making money, but it doesn't matter (yet)

Snowflake is an unprofitable company. In fact, it has lost over $388 million in the first six months of fiscal 2023. But there are three important reasons why this isn't a problem just yet.

First, Snowflake had a very high gross profit margin of 75% in the second quarter, which affords it plenty of flexibility when it comes to fine-tuning its expenses. Once the company achieves an appropriate level of scale, it can simply trim its operating costs and potentially become profitable on the bottom line. It's improving already -- its net loss was equal to 42% of its revenue during the first six months of fiscal 2023, compared to 78% during the same period last year.

Second, Snowflake has nearly $4 billion in cash, equivalents, and short-term investments on its balance sheet, which means it has a long runway before it hits funding issues. Therefore, it's a good move to continue spending aggressively as long as the company is growing as quickly as it is right now.

That introduces the third point. Snowflake most recently had a ridiculously high net revenue retention rate of 171%, which means its existing customers spent 71% more with the company during the second quarter of fiscal 2023 than they did during Q2 of last year. As a result, theoretically speaking, each new customer Snowflake acquires could become 71% more valuable with each passing year, so it's wise to spend money hand over fist to get them in the door.

It's little wonder Snowflake has attracted an investment from Buffett's Berkshire Hathaway. It might not be the type of stock the conglomerate typically buys, but that simply reinforces the quality of Snowflake's business.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.