This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Commentators everywhere are professing that a recession is nigh, and there's reason to believe they're right. The market is down, inflation is up, and inventories are starting to bulge with unsold goods. If you're feeling a mounting sense of doom, you're definitely not alone.

But none of the above are good reasons to sell your biotech stocks. In fact, there's a compelling argument that recessions are exactly when you should be buying them. Let's go through a few of the paradigms that explain why.

Here's why selling might be ill-advised

The first reason to refrain from selling your biotech stocks during a recession is that the drug-development cycle is typically much longer than the duration of most recessions, and it can often take upwards of 12 years to move a candidate from early research through the entire clinical trials process. On average, recessions last 17.5 months, but the latest recession in early 2020 only lasted two months. Remember, most biotech companies can't generate much in the way of revenue until they have a medicine that's approved for sale. So if they don't have any drugs on the market and a recession occurs, nothing changes about their sales.

Nor does much of anything change about their chance of earning future sales as a result of successfully commercializing a medicine. Only around 20.9% of drug candidates manage to make it through the entire clinical trials process and reach the market, and failures along the way are almost always due to an unacceptable safety profile or weak efficacy. Economic factors can't detract from or make up for a drug's clinical performance, though they could negatively impact sales -- but it's not a given that sales will fall.

Even for companies that already have products on the market, recessions aren't a deal breaker because revenue can still grow when the economy is shrinking. Take Seagen's (NASDAQ: SGEN) performance during the Great Recession as an example. Its quarterly revenue grew by 62.9% from the middle of June in 2007 through the same time in 2009.

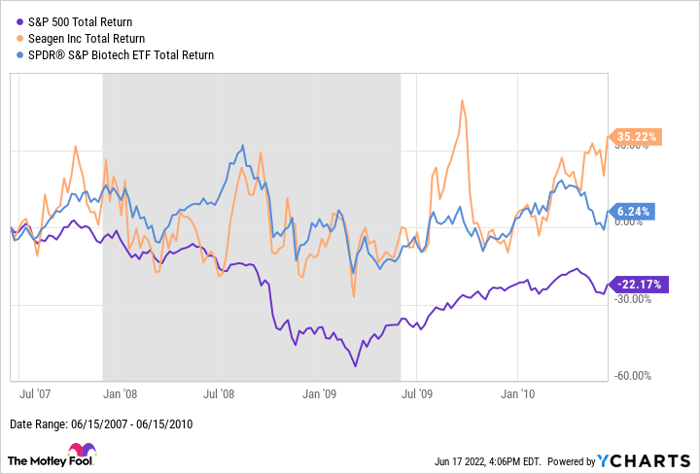

While its shares did still lose value during that period, their decline of around 6.5% was far less than the market's collapse of more than 39.7%. And if you held your shares from right before the recession officially started until a year later, you'd be sitting on significant gains compared to the market's performance -- and that was true for more than just Seagen, as shown below:

That's right: The industry-tracking SPDR S&P Biotech ETF beat the market both during and immediately after the recession. Especially for biotech investors who love to diversify within the industry, that's a strong confirmation that selling your shares in the face of economic turmoil could be a big mistake.

It might even make sense to buy

For risk-tolerant investors, recessions are actually a great time to load up on shares of attractive biotechs when they're cheaper than normal. The trick is to understand which companies have declining share prices because of events beyond their control and which are likely to struggle in a recessionary environment.

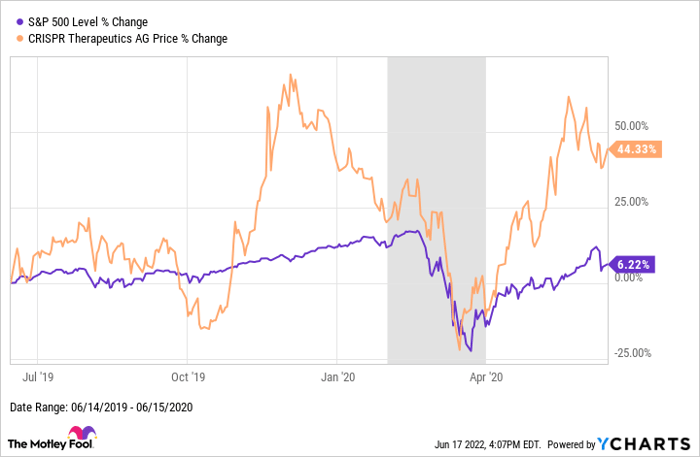

Consider CRISPR Therapeutics (NASDAQ: CRSP) as an example; it has more than $2.2 billion in the bank but trailing 12-month operating expenses of only around $592 million. Its pipeline has a handful of mid-stage gene-editing therapies, and its share price bounced back promptly to smash the market's return after the coronavirus crash and recession. Take a look:

As you can see, if you find biotechs that fit the bill, recessions can be an appealing time to invest. Biotechs with plenty of cash, minimal expenses, and pipelines packed with late-stage programs are positioned to withstand recessions better than others. Falling share prices make issuing new stock an unattractive way to raise funds, and having a lot of cash relative to research and development (R&D) expenses and operating expenses means that management can afford to wait for better conditions before doing an offering.

At the same time, companies with a lot of late-stage programs are closer to realizing revenue than others, which means they'll also have an easier time getting debt financing if it's necessary. If you already hold shares of the sturdier contenders, know that selling might well help you avoid some short-term losses -- but there's also a good chance it'll preclude you from realizing long-term gains once the economy recovers.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.