This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Apple (NASDAQ: AAPL) is one of the world's best-known companies. But one of the characteristics it is least known for is its dividend payment. The company is relatively new to the dividend-paying list of stocks and is far from reaching Dividend King status. The tech giant resumed paying a dividend in 2012 after a 17-year pause.

Still, Apple could be an excellent dividend stock for investors who buy it today. Let's look at its capacity to pay dividends and consider its valuation to determine its virtues as a dividend stock.

Apple has delivered robust dividend growth

Income investors can be encouraged by Apple's acceleration of dividend payments. From 2012 to 2021, the company has increased its dividend per share from $0.10 to $0.85. That means shareholders saw their dividends grow more than eightfold in that time.

In that same period, earnings per share rose from $1.58 to $5.61. Earnings are crucial to sustaining a dividend payment. In that regard, Apple's quality earnings growth is a good sign for the prospects of dividend increases.

Its earnings are buoyed by continued innovation in its products, like the iPhone, Apple Watch, AirPods, and iPads. Supplementing that is a robust and expanding services segment that totaled 20% of revenue in its most recent quarter, which ended March 26. The rise of the services segment is crucial because it generated a gross profit margin of 72.6% vs. a gross profit margin of 36.4% for its products.

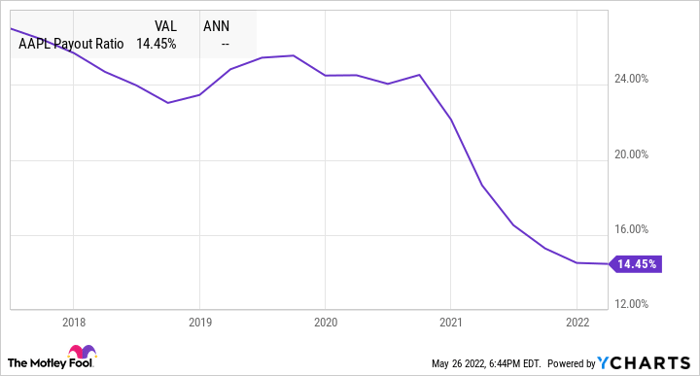

AAPL payout ratio data by YCharts.

While Apple's current dividend yield is a modest 0.65%, there's plenty of room for it to grow when you consider the company's dividend payout ratio. This is the percentage of earnings paid out in dividends. Most recently, Apple's dividend payout ratio was 14.5%, so the company could sustainably increase its dividend payment even if earnings remained constant, or sustain its current dividend even if profits decrease. The lower the percentage, the more wiggle room a company has in its dividend payment.

Apple's stock is not expensive

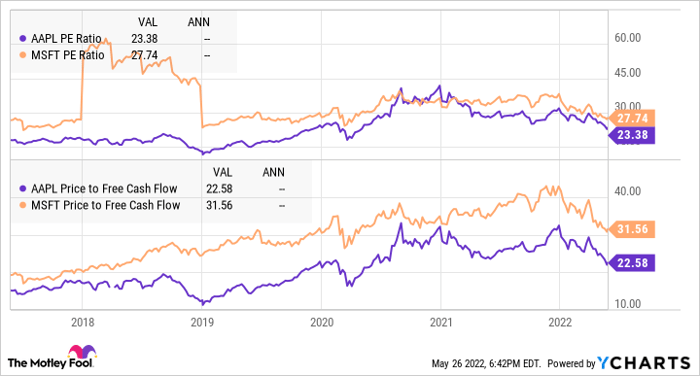

Comparing Apple's price-to-earnings (P/E) and price-to-free-cash-flow (P/FCF) ratios to their historic levels reveals that it is valued slightly above the average for those ratios over the past five years. In other words, in the last five years, there were times when Apple was pricier and times when it was cheaper.

AAPL P/E ratio data by YCharts.

Another way to measure valuation is a comparison with a competitor. Using the same metrics, Apple sells at a discount vs. one of its rivals, Microsoft (NASDAQ: MSFT). Of course, it is not an apples-to-apples comparison (pardon the pun), but Microsoft is a big tech stock with a mix of hardware and software revenue.

Accordingly, income investors who buy Apple stock today will probably thank themselves 10 years from now. To more directly answer the question in the headline, yes, Apple is an excellent dividend stock to buy.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.