This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Investing can feel overwhelming when you're just starting. The internet and social media have made it easy to access information, but it can be hard to separate good information from bad.

So if you're looking to begin building a portfolio, where do you start? The S&P 500 is a collection of the 500 most prominent companies in America. Most consider it the 'benchmark' of the broader stock market, and its returns have averaged 10.5% annually since its inception in 1957.

It's straightforward to build wealth using the S&P 500; here is a way you can do it and what you can expect over the long term.

Building a foundation with index funds

It would be best to build a strong foundation for your portfolio that you can slowly add to over time. Like a house, if you build a foundation that crumbles, the whole house will fail. It's similar to investing; you want quality holdings that can steadily build wealth for you over time.

Index funds are a great tool to consider. An index fund is a collection of stocks that trade under a single ticker symbol; it mimics the performance and behavior of an index by design, like the S&P 500, for example.

Index funds are a form of passive investing where investors sit on their hands and let the companies they own do the heavy lifting, which is to grow and increase in value. It can be much less stressful than active investing, where you're frequently buying and selling to optimize your portfolio, and investors usually trade their way to poor returns.

But don't assume that only beginners use index funds and that they're inferior to the hedge funds you often hear about on the news. Famous investor Warren Buffett once successfully bet that a hedge fund manager couldn't outperform a basis S&P 500 index fund over ten years.

An excellent index fund worth considering

An index fund that mimics the S&P 500 should be considered "investing 101" and could be a great backbone for any successful stock portfolio. One of my favorite funds is the Vanguard S&P 500 ETF (NYSEMKT: VOO) which gives you exposure to 500 of the best companies in America through one ticker symbol.

A fund like Vanguard S&P 500 makes investing so simple; you can methodically buy shares over a long enough time and let the most dominant companies in America continue to grow, building wealth for you over time. It's almost like investing on 'autopilot'.

There are people behind these funds who build and maintain them, so they take a tiny percentage of the funds you invest as compensation, called the expense ratio. Investors need to watch expense ratios because a high ratio can add up over time and reduce your total investment returns.

Vanguard S&P 500 has a meager expense ratio, just 0.03%! In other words, you'll pay the fund manager just $3 on a $10,000 investment. Considering how easy the fund makes it to follow the S&P 500, that seems like a terrific deal.

How much can you make?

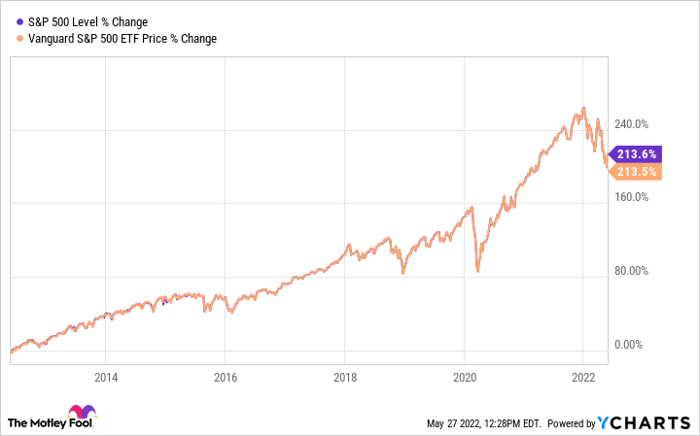

Your investment returns largely depend on you, specifically -- how much you invest and how long you let it compound in the market. However, here is what you can expect: The S&P 500 returns an average of 10.5% annually, and you can see how well Vanguard S&P 500 has done at mirroring the index.

Generating 10.5% annual investment returns means that your money will double every seven years. Suppose you invest $10,000 today. That means if those returns continue, then you could have $20,000 in seven years, $40,000 in 14 years, and $80,000 in 21 years. Get the point? Stock market returns will probably be "lumpy" in practice, but this is what it averages over multiple decades.

If you invest early and often, your money has more time to multiply. Too many investors start from nothing and try swinging for the fences with risky stocks from day one. Instead, consider building a compounding machine with a fund like Vanguard S&P 500 and watch your wealth grow.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.