This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Investing in dividend stocks can be an excellent way to build wealth over time. It can also provide a recurring income during retirement. Indeed, there are several benefits to investing in dividend stocks, but one downside is excluding top stocks that have not yet started to pay a dividend.

Typically, when businesses have more growth opportunities than they have cash, they reinvest any money the business generates into growth areas. Eventually, cash from operations exceeds growth opportunities and the funds needed to sustain the business for successful companies. At that time, a company looks to return capital to shareholders.

Netflix (NASDAQ: NFLX) is still in the growth phase. It is spending nearly all the cash the business generates on growth opportunities, mainly in creating content. Let's consider if Netflix can eventually become an excellent dividend stock.

Netflix has the right characteristics

As of March 31, Netflix boasts 222 million streaming subscribers. That was up by 6.7% from the same time last year. Management thinks the company has a long runway for growth and can potentially reach 500 million streaming subs in the long term. The 500 million total could give investors an idea of when the company may start paying a dividend. Until it approaches that sum, it will likely invest in ways to attract more subscribers.

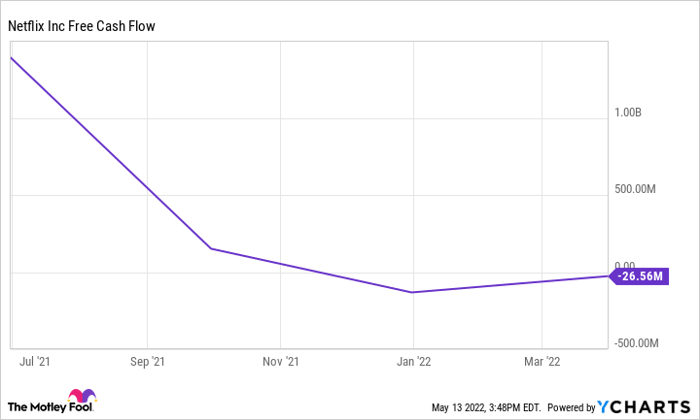

Recently, its most important use of cash has been to create or purchase content for the platform. That makes sense. As a streaming service, it attracts users with its content. Netflix has spent close to $9 billion in cash on content in its most recent two quarters combined. To put that figure into context, Netflix earned roughly $16 billion in revenue during that time. This massive investment primarily in content leads Netflix to approximately break even on cash flow.

NFLX Free Cash Flow data by YCharts

Eventually, if Netflix reaches the 500 million subs it's targeting, it can bring in so much revenue that the content budget will make up a smaller percentage. Additionally, Netflix has spent an increasing share of its content budget on Netflix creations instead of licensing deals in recent years. The implication of this is that it builds up Netflix's content library permanently rather than temporarily. A massive content library could retain and attract subscribers without Netflix necessarily investing aggressively in new content.

There is undoubtedly a visible path to when Netflix could generate sufficient free cash flow to pay a dividend. Once it does start paying a dividend, it could also increase it at a steady and predictable rate. Netflix's subscriber-generated revenue is non-cyclical and recurring. It will not be much of a mystery how much revenue and free cash flow Netflix will generate in the years that follow it reaching an equilibrium subscriber total.

Should dividend investors buy Netflix stock in anticipation?

The answer to that question depends on when you want those dividends. If you need the investment to start paying dividends in the next five years, no, Netflix may not be a suitable investment. The company may still be investing most of its cash in content. However, if your time horizon is 10 years or longer, then Netflix could be an excellent dividend stock by then.

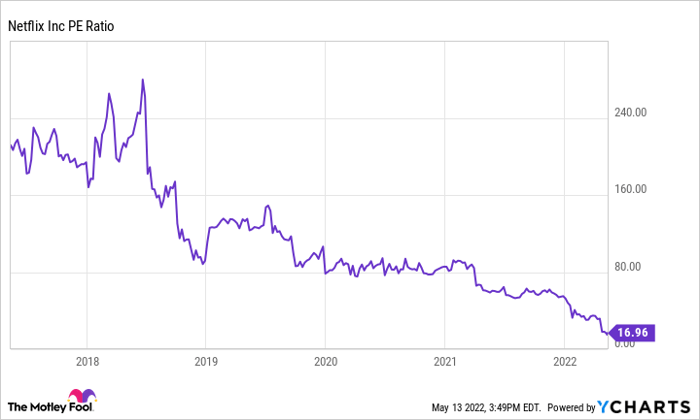

NFLX PE Ratio data by YCharts

To make the case more compelling, Netflix stock has scarcely been cheaper when measured by the price-to-earnings (P/E) ratio than it is right now.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.