Oil remains buoyant this week with Brent crude now back above US$100 per barrel. At the time of writing, it is fetching US$108/Bbl.

In the meantime, natural gas markets continue raging to yearly highs with the natural gas price nudging US$7.05/MMBtu on Thursday.

Woodside Petroleum Ltd (ASX: WPL) shares are also lifting in afternoon trade to $32.36. This follows an announcement by Woodside today that it plans to list on the New York Stock Exchange (NYSE).

US listing plans give Woodside share price a bump

Woodside shares are currently up 0.97% at the time of writing.

The company proposes the listing to occur after the merger with BHP Group Ltd (ASX: BHP), which is set for June.

Woodside said it hopes to list in June after the merger with BHP is finalised. Last week, the pair took another step on the ladder in gaining third-party approval from an independent auditor.

"The listing on the NYSE is expected to become effective on completion of the Merger, targeted for

1 June 2022," Woodside said. "Each Woodside ADS represents one ordinary share of Woodside."

The company stated further:

The Registration Statement relating to these securities has been filed with the SEC but has not yet become effective. These securities may not be sold nor may offers to buy be accepted prior to the time the Registration Statement becomes effective.

The effect on ASX investors is there will be more liquidity, which has implications for trading activity.

Investors seeking more information on Woodside's ADS listing can read the F-4 and F-6 forms here.

Woodside share price snapshot

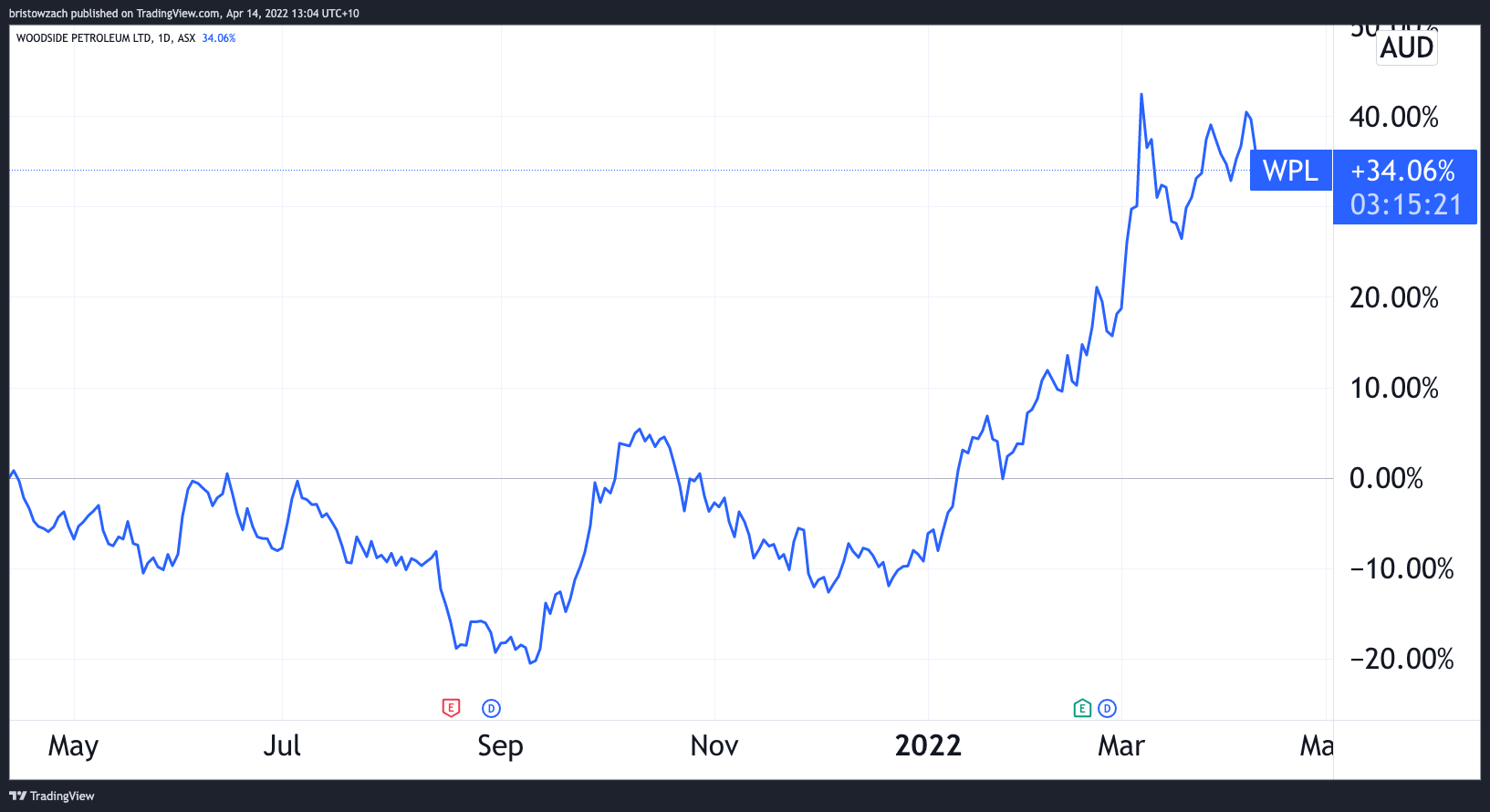

Woodside shares have climbed 47% this year to date and are up by 34% over the past 12 months.