This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Stocks in the electric vehicle (EV) sector have attracted loads of attention following the success of Tesla's (NASDAQ: TSLA) stock and now its business. Tesla reported net income of more than $5.5 billion in 2021. That helped confirm the company could profitably grow as the EV sector matures, which many supporters and shareholders have preached for several years.

That has attracted speculative investors looking for "the next Tesla" and has driven valuations to astronomical levels for several companies, like Rivian Automotive, that have barely begun delivering vehicles. But several of China's EV companies have already proven they can manufacture at scale. Although there are unique risks associated with these businesses, there are also concrete reasons why those who want exposure to the sector should consider investing in them now.

Targeting the right markets

There's a reason why Tesla's first manufacturing facility outside the United States was built in China -- it's the largest automotive market in the world. Chinese EV makers have been working to take advantage of that, too. Nio (NYSE: NIO), XPeng (NYSE: XPEV), and Li Auto (NYSE: LI) have each been increasing sales quickly over the past two years.

Data source: Company releases. Chart by author.

Although they're building off of a much smaller base than Tesla, these three Chinese EV makers increased vehicle sales between 109% and 263% in 2021 compared to 2020 levels. And though Nio, XPeng, and Li are completely focused on electrified vehicles, Chinese internal combustion and EV automotive giant BYD (OTC: BYDDY) is producing many more new energy vehicles (NEVs), which are defined as both electric and plug-in hybrid models. Sales volume for BYD new energy vehicles soared 218% to more than 600,000 in 2021. It also told investors it expects to potentially double that in 2022 to 1.2 million, reports industry follower CnEVPost.

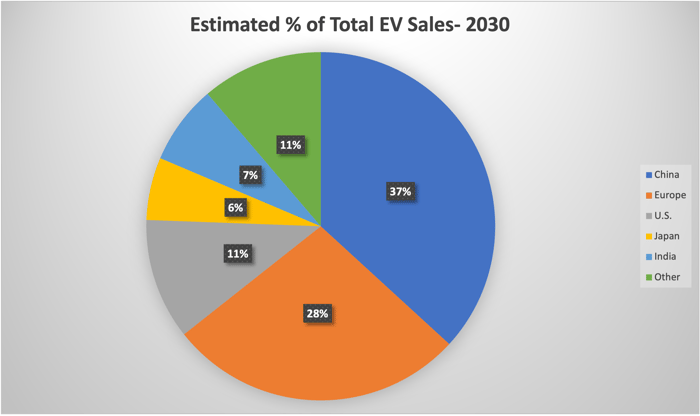

Though focused mostly on China to this point, these companies also plan to expand beyond those borders. BYD is a global company already, and Nio has established a presence in Norway. Nio has also said it plans to move into Germany, the Netherlands, Sweden, and Denmark in 2022. The International Energy Agency (IEA) predicts China and Europe will continue to dominate EV sales over the next decade, as shown below.

Date source: International Energy Agency Global EV Outlook 2021 report. Chart by author.

Competition and other risks

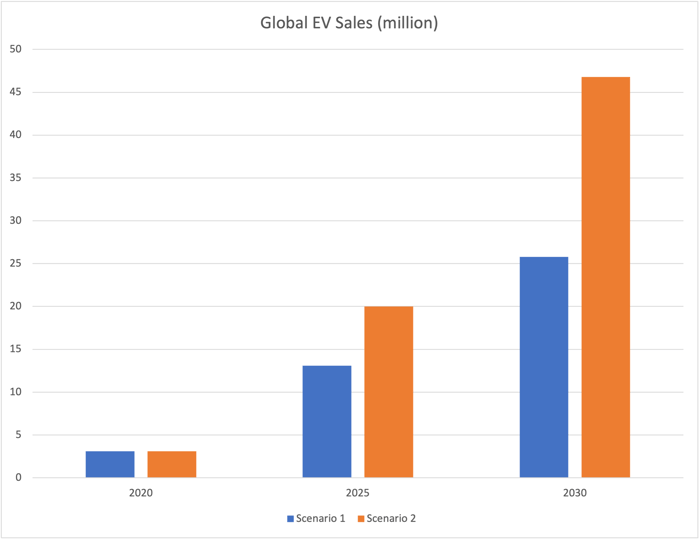

The IEA Global EV Outlook for 2021 predicts two scenarios for EV sales over the next decade. The first, more conservative, view is based on stated governmental policy objectives. The second assumes a more aggressive sustainable development push that results in EV sales obtaining a 34% share of the automotive market by 2030 -- more than double what the stated policy is expected to achieve.

Data source: International Energy Agency. Chart by author.

Though competition is ramping up from both start-up companies and established legacy automakers, both scenarios provide ample opportunity for the Chinese EV companies to continue growing sales.

To be sure, Chinese EV companies and their respective shares carry added geopolitical risks. For this reason, investors should size allocations appropriately. But based on businesses that have already shown they can be successful, and markets that provide ample opportunities, investors wanting exposure in the sector shouldn't overlook these companies.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.