This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Wall Street remained somewhat choppy on Wednesday morning, as investors remained divided in their views of the prospects of various industries within the stock market. As of 10 a.m. ET, the Dow Jones Industrial Average (DJINDICES: ^DJI) was up 18 points to 36,817, which would be a new record high if it holds onto those gains. However, the S&P 500 (SNPINDEX: ^GSPC) had fallen 3 points to 4,791, and the Nasdaq Composite (NASDAQINDEX: ^IXIC) had lost 67 points to 15,555.

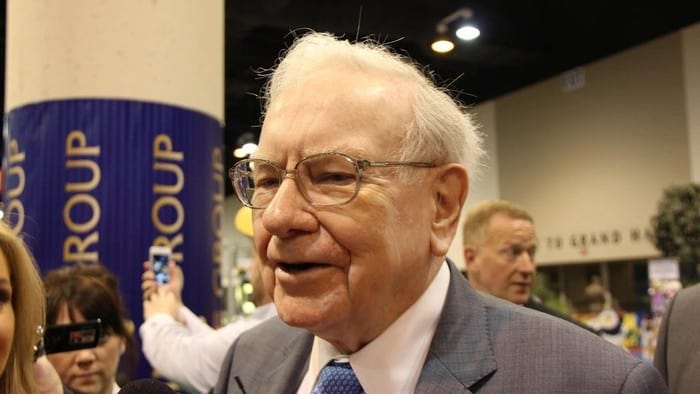

Evidence of a market rotation continues to pile up, and one of the clearest signs of the possible ascendancy of value investing came from Omaha, Nebraska. Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) shares were up another 2% on Wednesday morning, bringing its gains in the first two and a half trading days of the year to nearly 5% and representing a record stock price level for Warren Buffett's company. Given the gains that other stocks have seen, some investors wonder if Berkshire could finally make its way into the $1 trillion market capitalization club sometime in 2022.

A tough few years

Some investors in Berkshire Hathaway have been disappointed with the stock's performance in recent years. A persistent preference from investors for higher-growth companies has contributed to underperformance from Berkshire stock, with its 91% total return over the past five years trailing the S&P 500's 130%.

Berkshire has also had its share of miscues. Buffett's decision to sell out of airline stocks near their lows in March and April 2020 received widespread criticism, as it seemed to resemble a panic-driven sale and was soon followed by a massive rebound in the airline industry. Meanwhile, the stock didn't seem to get much credit for Berkshire's massive holding in shares of Apple, which have skyrocketed over the period.

Growth-oriented investors also question why Berkshire keeps so much cash on hand. Even with the company making increasingly substantial repurchases of its own stock, Berkshire had nearly $150 billion in cash on its balance sheet as of its most recent quarterly report. That cash on the sidelines earning next to nothing was arguably a big drag on potential investment performance.

Seeing value

More recently, though, investors have seemed to recognize the intrinsic value of Berkshire's businesses. Wholly owned companies in areas like energy and transportation are starting to show signs of strength, and even with Buffett having dramatically cut exposure to the banking sector, Berkshire's holdings there are benefiting from the prospects for rising long-term interest rates that could bolster net interest income.

Perhaps most importantly, many shareholders see Berkshire as a counter-trend play that offers portfolio diversification when combined with higher-growth stocks. Despite some recent purchases of positions in companies like data warehousing specialist Snowflake, Buffett's conservative style is likely to remain in place at Berkshire even once he's no longer able to lead the company.

Is $1 trillion within reach?

Berkshire's market capitalization just topped the $700 billion mark, so it'd take a better-than-40% gain from here to reach $1 trillion. That's a tall order for Berkshire in 2022 even after years of underperformance. However, some of the trends that have created big headwinds for the insurance conglomerate appear to be shifting, and that suggests that even if it doesn't happen this year, Berkshire could put together the gains necessary to join the trillion-dollar club before too much longer.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.