The Afterpay Ltd (ASX: APT) share price is in the red on Monday afternoon.

At the time of writing, shares in the buy now, pay later provider (BNPL) are off by 2.39%. This mirrors the poor performance more broadly across the tech sector to kick off the week. For context, the S&P/ASX 200 Index (ASX: XJO) is down 0.51% this afternoon.

Although the market is not looking at Afterpay too fondly today, it was a different story on Wednesday last week. Shares in global payments company gained 2.1% on the back of its annual general meeting (AGM). In this meeting, more information was shared about Afterpay's analytics platform, 'Afterpay iQ'.

Let's take a look at the details.

Let's get analytical

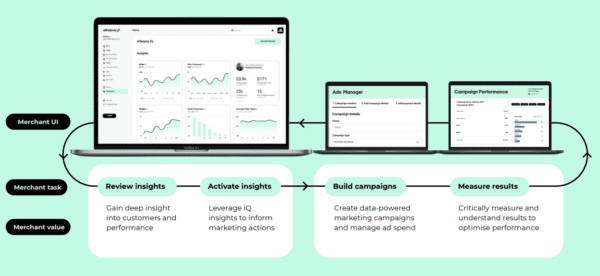

On 19 August 2021, Afterpay announced its merchant analytics platform. At the time, the new tool was described as a way for merchants to access and leverage valuable customer-centric analytics derived from the Afterpay network.

Furthermore, the internal system is powered by artificial intelligence (AI) — crawling through more than 156 million transactions of the past year. From this, ASX-listed Afterpay can provide merchants with data-rich insights. This can assist retailers in devising data-driven marketing campaigns.

Additionally, Afterpay chair Elana Rubin discussed the merits of Afterpay iQ at Wednesday's AGM, stating:

We've leveraged merchant and product level data in order to create personas and it gives insight into customer motivations.

In regards to privacy, Rubin noted:

This portal is designed to help merchants understand their performance with Afterpay. But consistent with all the privacy segments, as such the only data [the] merchant can see in the portal is their own, which has been de-identified and is only shown on an aggregated persona basis.

The technology was created by Afterpay's engineers after merchants had been asking for ways to leverage Afterpay's product. From its AGM presentation, some of the available insights include sales, new customers, orders, and order frequency.

From here, advertisements can be deployed and reviewed directly from Afterpay iQ.

Afterpay on the ASX

Because of the pending takeover by US-based Square Inc (NYSE: SQ), Afterpay's days of trading on the ASX are likely numbered. The scheme booklet has been sent out to Afterpay shareholders for voting on the transaction. If approved, the Aussie company will be engulfed by the larger payments giant.

Despite these events, the Afterpay share price is in the negative on a year-to-date basis — down roughly 4%.