What kinds of historical returns does the S&P/ASX 200 Index (ASX: XJO) offer?

Most investors worth their salt will tell you that most of the money made on the ASX 200 (or any other) share market is made through combining compound interest with time. The great Warren Buffett is one of them. He once famously said that "the stock market is a device for transferring money from the impatient to the patient".

There's no better way of seeing this compounding in action than by looking at the past returns of a share market. Only then can one really appreciate the wonder of compound interest. We all worry about the next share market crash, but the boring-but-beautiful truth is that shares tend to go up far more often than they go down.

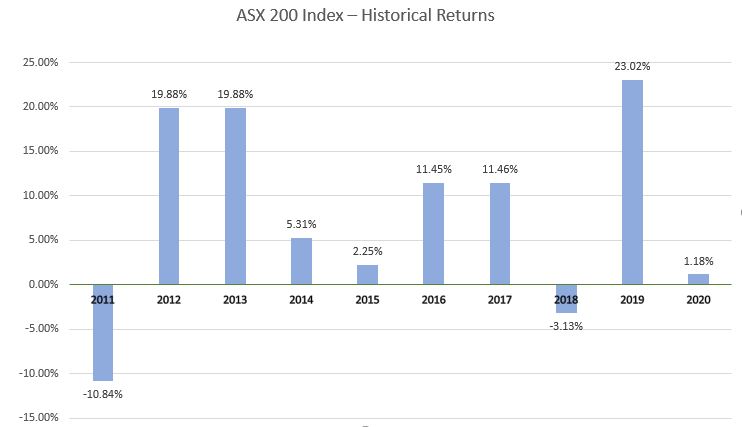

ASX 200 historical returns: 2011-2020

So let's take a look at the ASX 200's historical returns over the past ten years. These returns, courtesy of S&P Global, the company that runs the ASX 200 Index, include the benefits of dividends paid:

| Year | Return of ASX 200 |

| 2011 | (10.84%) |

| 2012 | 19.88% |

| 2013 | 19.88% |

| 2014 | 5.31% |

| 2015 | 2.25% |

| 2016 | 11.45% |

| 2017 | 11.46% |

| 2018 | (3.13%) |

| 2019 | 23.02% |

| 2020 | 1.18% |

And here is that data in visual form:

As you can see, it's been a lot more 'up' than 'down' over the past decade, albeit with the occasional bout of market volatility. It's especially fascinating to see that the index even managed to eke out a positive gain last year, even after the worst market crash in a decade.

As it stands today, the ASX 200 looks set to enjoy yet another positive year in 2021 (touch wood), seeing as the Index has managed to put on an additional 11.33% in 2021 so far. Although we still have two-and-a-bit months to go until the end of the year, one could say things are looking promising.