September turned out to be a pretty disappointing month for the S&P/ASX 200 Index (ASX: XJO), now that we have the gift of hindsight.

Over the month just gone, the ASX 200 went backwards by about 2.7%. It fell from roughly 7,535 points at the start of the month to the 7,332 points that the ASX 200 closed at on Thursday 30 September.

But how did the ASX 200's largest constituent, the Commonwealth Bank of Australia (ASX: CBA), fare over September?

As the largest share by market capitalisation (and therefore ASX 200 weighting), CBA usually sets the trend for the entire ASX 200. So, let's check out how this ASX bank contributed to the ASX 200 performance over September.

The ups and downs of the CBA share price

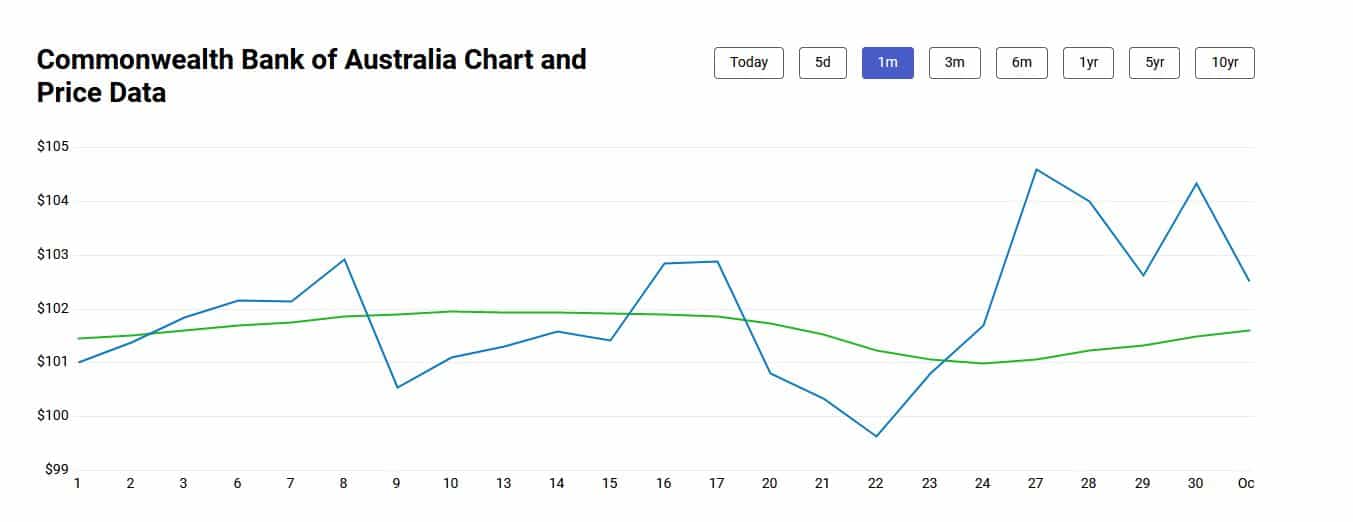

So, CBA started September at a share price of $100.12. On Thursday, this bank closed at a price of $102 a share, on the dot. That puts the bank in the green for September, clocking a rise of 1.88% for the month.

Of course, that doesn't tell us all there is to know about CBA's September. The bank had quite a month, rising as high as $104.59 later in September, and falling as low as $99.64 a share before that.

You can see what kind of a month CBA shares had here:

So, now we are officially in October, what's next for CBA?

Could CBA shares be a buy?

One broker who doesn't think so is Morgan Stanley. As my Fool colleague James covered recently, this broker currently rates CBA as 'underweight' with a 12-month share price target of just $90. That implies a potential 12-month downside of roughly 10% from recent pricing.

Morgan Stanley is estimating that financial regulators will have to take steps to cool the Aussie housing market soon, which might lead to a slowdown in credit growth and a potential negative impact on the CBA share price.