The CSL Limited (ASX: CSL) share price has been a major ASX winner over the past decade. Plus, it's got the results to prove it.

Whereas the S&P/ASX 200 Index (ASX: XJO) has gained 83% over the past 10 years, CSL shareholders have enjoyed far healthier gains.

We've done the math to show you the possible benefits of long-term investing, using CSL as a case example.

Invest with a long-term horizon in mind

Biotechnology player CSL has been in the vaccines market for more than 25 years. Since listing in 1994, its shares have exhibited tremendous long-term capital appreciation.

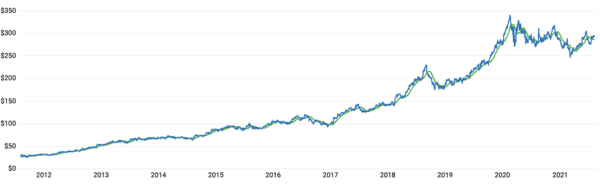

Imagine we are a prudent investor with a long-term forward way of thinking. Next, imagine we invested $1,000 in CSL shares at the closing price of $28.39 per share back on 5 August 2011. That's roughly 35 shares.

The first way we need to examine our return is to calculate the capital gains on our shares. In doing so we realise a return on investment of 943%, which is quite handy given the broad index's return.

CSL share price over last 10 years — now

Source: The Motley Fool

That implies our original position is now worth approximately $9,430. However, that ignores one half of the equation. We also need to factor in the effect of CSL's dividend, in order to assess our total return.

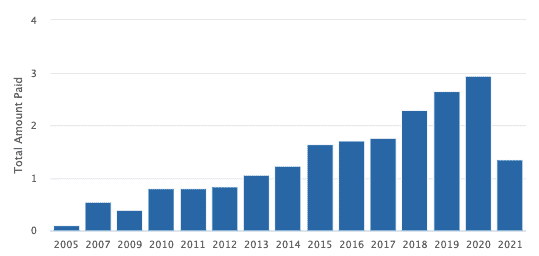

The effect of CSL's dividend

Over the course of our examination period, CSL has returned $17.90 per share to shareholders by way of its dividend.

CSL has grown its dividend payment at a compound annual growth rate (CAGR) of 5.3% since 2011.

However, taking out the significant down-step in 2021, it has grown its dividend at a CAGR of approximately 14% over the same period.

CSL dividend history

Source: The Motley Fool

Adding in CSL's dividend schedule, our total return mushrooms to more than 1005% over the previous 10-year period. This implies our position is now worth $10,056.

Some very interesting outcomes arrive when we make a few tweaks to our calculations. Let's assume we reinvested the dividends received to buy more CSL shares along the way.

Harnessing the value of this dividend reinvestment plan (DRIP) yields a total return of 1,124% on our original investment.

Therefore, it suggests long-term investing can have tremendous payoffs, if done correctly.

Foolish takeaway

Several things to always remember when investing.

First, long-term investing can work. While past returns are no guarantee of future performance, the ASX 200 has risen 83% over the past 10 years.

Second, always complete due diligence and the necessary research before allocating hard-earned capital. Finally, risk management is paramount. Maintaining an investment with conviction over a long-term horizon can be a winning formula, as evidenced through the case of CSL shares.