After a recent run-up on the charts, Mineral Resources Limited (ASX: MIN) shares have delivered a total return of 155% over the past 12 months.

Mineral Resources shareholders have enjoyed this total return as a combination of capital gains and dividend payments of $1.77 per share over this period.

Here, we evaluate Mineral Resources shares from the perspective of their dividend yield, for the benefit of investors who are considering buying the stock ahead of its next dividend announcement in August.

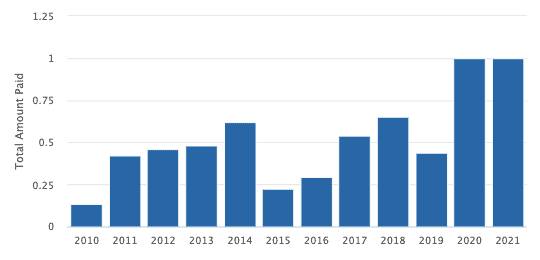

Some history on the Mineral Resources dividend

Mineral Resources has been returning cash to its shareholders via its dividend since November 2010.

Over this ten-year period to date, the company has made good on each respective payment, completing two dividend payouts a year.

Mineral Resources was even able to increase its dividend throughout the pandemic, in a testament to the resilience of its dividend program and business model.

Exhibit 1. Mineral Resources Dividend Payments, 2010 – 2021 (current).

Source: The Motley Fool Australia

From November 2010 to March this year, Mineral Resources' dividend payout has grown at a compound annual growth rate (CAGR) of approximately 20%.

In addition, the dividend is fully franked, meaning there is no 'double taxation' on the income for shareholders.

The company pays this tax before distribution, and this is credited to shareholders by way of franking credits.

What does the dividend look like today?

Let's look back a little further than July 2020 to get a better scope on Mineral Resources' dividend situation.

Mineral's most recent dividend payment was $1.00 on 9 March, meaning total dividends received from 26 March 2020 to 9 March 2021 equals $2.00 per share.

In other words, investors who held 100 shares in Mineral Resources over this time period would have received a total pay-off of $200 in dividend income (100 x $2.00 = $200).

But what about the dividend yield?

When considering an investment in Mineral Resources shares to capture the dividend payment, the concept of dividend yield is relevant.

Put simply, the dividend yield is a financial ratio that states the return an investor will receive from a company's dividend payouts, based on its current share price.

For instance, if an investor were to allocate $1,000 to shares that are returning an annual dividend yield of 5%, they can expect a return of 5% on their initial investment, or $50 per year, from the dividends alone.

Note the above calculation excludes any share price movements up or down over the holding period.

Furthermore, there is an inverse relationship between dividend yield and share price. When the share price goes up, yield goes down and vice versa.

Given that Mineral Resources' share price has exhibited considerable appreciation over the past year, it stands to reason that its dividend yield has declined over this time. However, its dividend payout increased, both on an interim and final payment basis.

Taking the total of $2.00 per share (from March 2020 – March 2021) and dividing this by Mineral Resources' share price of $63.24 at the time of writing, we arrive at a trailing yield of 3.16%.

Therefore, assuming no change in share price or dividend payouts, an investment of $1,000 in Mineral Resources shares today would land a return of $31.60 for the year.

Looking forward — what about the yield, then?

It is unrealistic to assume no change in the share price or dividend payments over the coming periods. Besides, Mineral Resources has increased its payouts at a CAGR of 20% over the past 10 years, as mentioned.

Looking forward, it is uncertain what Mineral's final dividend will look like when it is announced in August.

However, the analysts at JP Morgan forecast a dividend yield of 5.8% for FY21 and 6% for FY22.

These forecasts imply growth in dividends and also growth in the dividend yield, at the current market price.

Given these forecasts and the repeated pattern of dividend growth over the past 10 years, coinciding with share price appreciation on the charts, it stands to reason that JP Morgan likes Mineral Resources' dividend yield prospects.

Consequently, the investment bank has assigned a price target of $64.00 on the shares. This implies an upside potential of ~1.2% at the time of writing.

At that current price, Mineral Resources has a market capitalisation of $11.96 billion and trades at a price-to-earnings (P/E) ratio of 18.73.