This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

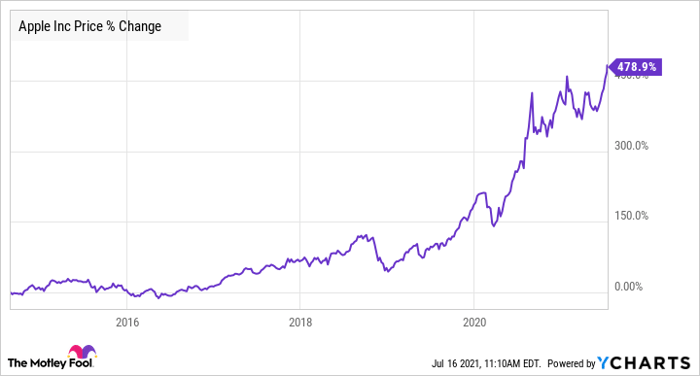

The iPhone 6 series was a landmark device for Apple (NASDAQ: AAPL) when it was launched in September of 2014, as it marked the company's transition toward bigger screens. The iPhone 6 and the bigger iPhone 6 Plus were runaway hits among consumers: Apple sold 10 million units of the devices in just three days of their launch. The sales momentum of the iPhone 6 models spilled over into 2015. In the first quarter of that year, Apple's iPhone sales surged 41% year over year to 74.5 million units, beating Wall Street's estimates of 67 million by a wide margin. Apple ended up shipping a record 231 million units in 2015, a number that it hasn't matched since. It is also worth noting the 478% Apple stock has soared since the iPhone 6 models went on sale in September 2014. But I think that Apple investors can expect a rerun of this impressive stock price rally in the coming years. Let's see why.

Understanding the 2014 Apple upgrade cycle

Market research firm Counterpoint Research rightly points out that the iPhone 6 triggered Apple's first volume supercycle as consumers shifted to larger-screen devices. The first iPhone, launched in 2007, had a screen size of 3.5 inches. Apple stuck to a 3.5-inch screen till the iPhone 4S was released in 2011, before moving to a 4-inch configuration for the iPhone 5 and the iPhone 5S in 2012 and 2013, respectively. Apple consumers got a taste of bigger screens for the first time with the iPhone 6. While the standard device had a 4.7-inch screen, the Plus model was even bigger at 5.5 inches. Not surprisingly, Apple consumers upgraded in droves, as large-screen phones were all the rage at that time. The company had been selling relatively smaller phones for over seven years by the time the iPhone 6 arrived, so it had a huge installed base that was raring to upgrade. Apple's iPhone installed base stood at 500 million in June 2014, so the tremendous sales growth triggered by the iPhone 6 models was a given. The launch of the iPhone 12 has kicked off another upgrade cycle for Apple, though on a much bigger scale.The iPhone 12 supercycle is all set to eclipse the last one

Unlike the last iPhone supercycle, which was led by a change in the form factor of smartphones, the current one is being driven by the arrival of 5G wireless technology. Telecom carriers around the globe are rolling out 5G networks at a rapid pace, and that's encouraging customers to buy devices to take advantage of the fast speeds offered by the new wireless standard. To put it simply, the current upgrade cycle is being driven by necessity. You can stick to an older phone with a small screen if that's a personal preference, but faster speeds are something consumers will always like to have. That helps explain why a Counterpoint Research study in 2019 found that consumers were willing to spend 20% more on 5G smartphones. All of this explains why the iPhone 12 is moving the needle in a big way for Apple. The device has sold 100 million units within just the seven months since it launched, mirroring the initial sales trajectory of the iPhone 6. The iPhone 12 models may have moved more units and exceeded the iPhone 6's initial performance had Apple not been hamstrung by the global chip shortage, which hindered production during the lucrative holiday season. However, investors shouldn't forget that this is just the beginning of the latest upgrade cycle. Counterpoint Research points out that the iPhone 12's installed base stood at 16% in the first quarter of 2021, which means that 84% of Apple's customers have yet to upgrade to a 5G smartphone. That's a huge number, as Apple CEO Tim Cook disclosed in January this year that there are more than 1 billion iPhones in use globally. That means there are more than 800 million iPhone users in an upgrade window, which is way bigger than the company's installed base in 2014. It is also worth noting that the 5G iPhones are driving Apple's average selling price higher. So Apple isn't just poised to record impressive volume growth in the coming years, it may also have some wiggle room to push its prices up. Analysts expect Apple to ship as many as 250 million iPhones this year, followed by at least 226 million units next fiscal year. That would still leave room for growth in 5G smartphone shipments considering the huge iPhone installed base. Throw in the improved pricing, and it isn't surprising to see that analysts expect Apple's earnings to grow at nearly 18% a year for the next half-decade, a big jump over the 8% annual growth seen in the last five years. And don't forget that Apple's margins are getting a nice shot in the arm thanks to the growing influence of its services business. Apple seems to be sitting on much stronger catalysts right now than it was nearly seven years ago, which is why it is likely to remain a top growth stock and potential multibagger, even after so many years of terrific gains.This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.