The Commonwealth Bank of Australia (ASX: CBA) share price continued to set new record highs last week. On Friday CBA shares hit an intraday, all-time high of $102.64 before closing the session at $102.52.

Last week, the Australian Bureau of Statistics (ABS) reported key lending indicators for new borrower-accepted finance commitments for housing, personal and business loans. The data could point to a continued recovery in consumer and business confidence, and for the broader Australian economy.

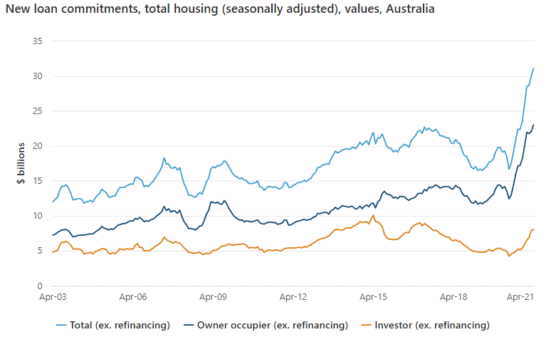

ABS lending indicators surge to record highs

The ABS reported that the value of new loan commitments for housing, owner-occupiers and investors increased 3.7%, 4.3% and 2.1% respectively in seasonally adjusted terms, in April 2021.

ABS head of finance and wealth Katherine Keenan said:

The value of new loan commitments for owner occupier housing reached another all-time high in April 2021, up 4.3 per cent to $23.0 billion. New loan commitments for investors rose 2.1 per cent to $8.1 billion, which was the highest level since mid-2017

The rise in owner occupier lending was driven by increased loan commitments for existing dwellings, which rose 9.2 per cent. Loan commitments to owner occupiers for the construction of new dwellings fell by 11.4 per cent, following a fall of 14.8 per cent in March. These were the first monthly declines since the Homebuilder grant was introduced in June 2020. However, the value of construction commitments remained at a high level.

From a year-on-year perspective, new borrower-accepted loan commitments for housing, owner occupier and investor increased 68.2%, 70.1% and 63.0% respectively in April.

In terms of business finance in April, the value of new loan commitments for construction fell 10.5% while loans for purchase of property rose 27.8%.

CBA share price at all-time highs

May was a breakthrough month for the CBA share price, closing above the iconic $100 mark for the first time ever. The move to record highs was supported by the bank's continued momentum in earnings, evidenced by its third-quarter results.

In the March quarter, CommBank delivered a cash net profit after tax of $2.4 billion, almost doubling the weak $1.3 billion from a year ago, and also topping the $1.70 billion in 2019 and $2.35 billion in 2018. The results release pointed to the following aspects driving the bank's solid earnings.

The Bank's franchise strength was again evident with above system growth in home loans supported by strong funding volumes and continued focus on credit decisioning turnaround times. Domestic business lending continued to grow at more than three times system, with diversified growth across sectors. Household deposits growth was also above system, growing by $4bn in the quarter