The Impedimed Limited (ASX: IPD) share price is bouncing this morning after the company announced positive progress in its SOZO technology for heart patients.

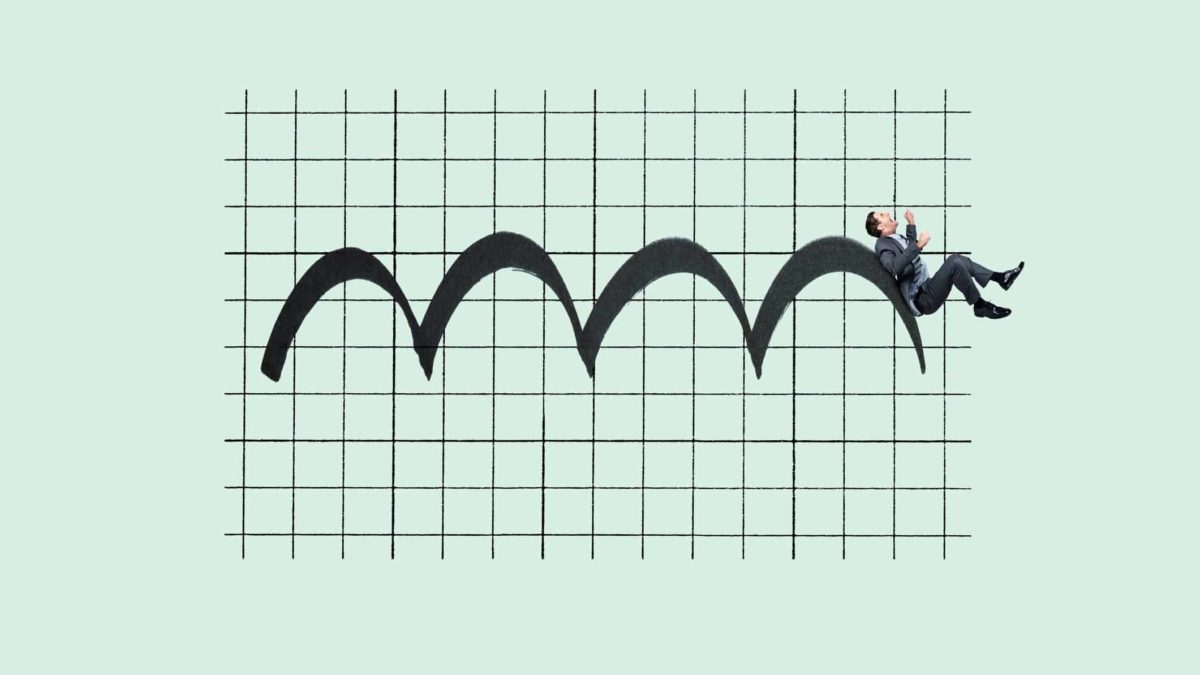

The Impedimed share price has been seesawing between the opening price of 12 cents and its current price of 12.5 cents per share, up 4.1%.

Founded and headquartered in Brisbane with US and European operations, Impedimed is a medical technology company that uses bioimpedance spectroscopy (BIS) technology, specifically its SOZO test, to help predict potential heart failure and prevent edemas and hospital readmission.

Impedimed is marketing its SOZO technology to US hospitals as a way of diagnosing the potential risk of future fluid overload in heart failure patients before they're released.

What did Impedimed announce?

Impedimed advised today The American College of Cardiology (ACC) journal reported finding there was a strong clinical correlation between a heart failure patient's HF-Dex level exceeding 51% at the time of release from hospital, and subsequent hospital readmission.

Impedimed's SOZO technology tests the HF-Dex level (extracellular fluid to body water ratio) of a patient and the company believes this finding will eventually help promote the use of its SOZO tests in hospitals across the world. This is especially the case in the US, where hospitals must cover the cost of patient readmission if it occurs within the first 30 days of their release.

The conclusion from the abstract states that HF-Dex measurements near the time of hospital discharge may help identify individuals at higher risk for readmission and may benefit from closer follow-up to reduce the likelihood of readmission.

ACC journal author Annie Burns expanded on the risk of fluid overload in heart failure patients.

After a heart failure related hospital stay, patients may experience improvement in symptoms even though fluid overload persists. This analysis shows that SOZO with HF-Dex has the potential to identify patients with fluid overload, who are at higher risk of readmission at the time of hospital discharge and would benefit from closer follow-up.

Impedimed called this "a significant finding, as the cost of hospital readmissions is enormous, costing the US healthcare system an estimated $31 billion annually".

More background on SOZO technology

SOZO is used in around 700 locations globally, as a point-of-care assessment tool to guide clinical decision-making and "maximise patient health".

Using ImpediMed's bioimpedance spectroscopy (BIS) technology, SOZO measures and tracks information about the human body to aid clinicians. According to the company, results from the 30-second test are available immediately on the device and online.

Impedimed share price snapshot

The Impedimed share price is up more than 200% over the past 12 months but has declined by nearly four cents since 2021 began.