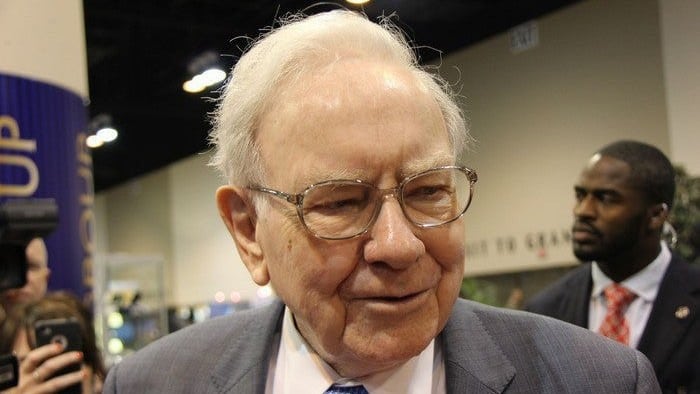

Warren Buffett – chair and CEO of Berkshire Hathaway Inc (NYSE: BRK.A) (NYSE: BRK.B) – is, without a doubt, one of the most followed investors in the world. And 'one of' is probably being conservative.

There are two events that every Buffett fan in the world has marked on their calendars: the annual general meeting of Berkshire Hathaway (which normally occurs in May). And, of course, the release of Warren Buffett's annual letter to shareholders, which he has been publishing like clockwork since the 1960s.

Buffett's annual letter hits the stands

One of those events has just happened. And since it's not May just yet, you can probably guess which one. Yes, Mr Buffett published his annual letter to shareholders over the weekend and, as always, it makes for some interesting reading. Investors hoping for a bold prediction as to where the current share market is headed next might be a little disappointed. But there were plenty of interesting observations (and pithy anecdotes) to go around regardless.

One of the more pertinent of those is the following. Buffett only devoted a single paragraph to this discussion point, but it was arguably one of the more decisive statements in the letter. It goes like this:

And bonds are not the place to be these days. Can you believe that the income recently available from a 10-year U.S. Treasury bond – the yield was 0.93% at year end – had fallen 94%from the 15.8% yield available in September 1981? In certain large and important countries, such as Germany and Japan, investors earn a negative return on trillions of dollars of sovereign debt. Fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future.

Why the bond age is set for a whipping?

Bonds, as you may know, are investments that represent loans. In this case, loans to a government. They are a popular asset class that many investors see as an alternative to shares. That's because they offer guaranteed income (remember, a dividend is never 'guaranteed'), and (usually) lower volatility than shares.

You can access the government bond market on the share market, though exchange-traded funds (ETFs) like the Vanguard Australian Fixed Interest Index ETF (ASX: VAF).

But why is Buffett so adamant that those investing in bonds "face a bleak future"? Well, the value of bonds is inherently tied to interest rates. If interest rates fall, the value of existing government bonds rise, and vice versa. And interest rates around the world have spent the better part of a decade steadily falling. The official cash rate in Australia is currently 0.1%, the lowest level in history.

Foolish takeaway

So even though bonds have been a fantastic investment to have had over the past ten years, according to Buffett, there's no longer much room for improvement. And if interest rates spend the next decade rising rather than staying flat, those holding bonds face a world of hurt. Put another way, there is arguably little chance bonds can keep rising in value, and a good chance they will fall. That's why Buffet is so unequivocal in his condemnation of the future prospects of this asset class.